I need to prepare both a CRA and a Revenu Québec tax return. What do I need to know?

At H&R block, we want to make preparing and filing taxes as straight-forward as possible. And we understand the added complexity for our Québec clients who have to prepare and file both a Canada Revenue Agency (CRA) return and a Revenu Québec return. Don’t worry – we’re here to help! Here are a few ways we make the process more straight-forward.

H&R Block tax software simplifies filing two returns by combining the most frequently used CRA and Revenu Québec forms onto one page. That means you can enter all your information in one place, then our calculations will do the rest.

Here are some examples:

- Statement of business or professional activities (T2125 and TP-80-V)

- Statement of employment expenses (T777 and TP-59-V)

- Statement of real estate rentals/Income and expenses respecting the rental of immovable property (T776 and TP-128-V)

- Moving expenses (T1-M and TP-348-V)

- Tax credit for donations and gifts (Schedule 9 and Schedule V)

- Tuition tax credit (Schedule 11 and Schedule T)

- Capital gains or losses (Schedule 3 and Schedule G)

- Child care expenses deduction/Tax credit for childcare expenses (T778 and Schedule C)

As a resident, you’ll receive both federal (CRA) information slips and corresponding Québec relevé slips. For example, your employment income will be reported on a federal T4 slip and on a Québec Relevé 1.

Here’s a chart to help you match the federal slips with their corresponding relevé slips.

| Federal information slip | Corresponding Québec relevé slip | What does it report? |

| T4 | Relevé 1 (RL-1), Relevé 22 (RL-22) | Salary, wages, tips, and other amounts paid to an employee |

| T4E | Relevé 6 (RL-6) | Employment insurance and parental benefits, taxable and non-taxable tuition assistance, provincial parental insurance benefits |

| T4PS | Relevé 25 (RL-25) | Dividends and capital gains (or losses) allocated to a beneficiary of a profit-sharing plan |

| T4RSP, T4A(P) | Relevé 2 (RL-2) | RRSP income |

| T4RIF | Relevé 2 (RL-2) | Amounts paid from a Registered retirement income fund (RRIF) |

| T4A | Relevé 1 (RL-1), Relevé 2 (RL-2) |

- Pension and annuity income, retirement income, lump-sum payments, self-employed commissions, and fee for other services - The RL-2 also reports amounts paid during a year to the surviving spouse and recipient of the property after the death of the annuitant, contributions a retired employee paid to private health services, and the amount paid to an annuitant of an RRSP under the HBP/LLP |

| T4A(OAS) | - | Old age security amounts |

| T4A(P) | Relevé 2 (RL-2) | Canada Pension Plan benefit amount, retirement and post-retirement benefits, survivor benefit, disability benefit, death benefit, and child benefit |

| T4A-RCA | - | Amounts paid from a retirement compensation arrangement (RCA) |

| T3 | Relevé 16 (RL-16) | Trust income allocations and designations |

| T5 | Relevé 3 (RL-3) | Investment income |

| T5003 | Relevé 14 (RL-14) | Tax shelter information |

| T5006 | Relevé 10 (RL-10) |

- Issued by registered labour-sponsored venture capital corporations for class A shares you might have acquired or bought. - The RL-10 reports class A shares in the Fonds de solidarité des travailleurs du Québec (FTQ) and class A or class B shares in Fondaction, le Fonds de développement de la Confédération des syndicats nationaux pour la coopération et l'emploi. |

| T5007 | Relevé 5 (RL-5) | Amounts paid to recipients of the worker’s compensation benefits, indemnities, and social assistance |

| T5008 | Relevé 18 (RL-18) | Securities transactions |

| T5013 | Relevé 15 (RL-15) | Income from a partnership |

| T5018 | Relevé 27 (RL-27) | Contract payments made to subcontractors for construction services |

| T10 | - | Pension adjustment reversal (PAR) |

| T101 | Relevé 11 (RL-11) | Information related to flow-through shares |

| T1204 | Relevé 27 (RL-27) | Contract payments issued by the government |

| T1212 | Deferral of security option benefits. | |

| T2202/TL11A/TL11C | Relevé 8 (RL-8) |

- Amount eligible for the tuition tax credit. - The RL-8 also reports the amount that parents can claim if their child chooses not to claim the tax credit. |

| RC62 | - | Universal child care benefit amount |

| RC210 | - | Canada Workers Benefit (CWB) payments |

| - | Relevé 7 (RL-7) | Information related to investments in a Cooperative Investment Plan (CIP) or a Stock Savings Plan II (SSP II) |

| - | Relevé 13 (RL-13) | Interest and bonuses received by the security owner or seller (Ownership certificate) |

| - | Relevé 19 (RL-19) | Advance payments of the tax credit for childcare expenses, the tax credit for home-support services for seniors and the work premium or the adapted work premium |

| - | Relevé 21 (RL-21) | Farm support payments issued by the government |

| - | Relevé 22 (RL-22) | Information related to an individual's coverage under a personal insurance plan |

|

-

|

Relevé 23 (RL-23) | Amount of the tax credit for volunteer respite services that are allocated by the caregiver to the volunteer |

| Official receipt issued by the childcare provider | Relevé 24 (RL-24) | Childcare expenses |

| - | Relevé 26 (RL-26) | Issued by the Capital régional et coopératif Desjardins corporation for amounts received for issue of shares and the amounts paid for the redemption or purchase by agreement of shares |

| - | Relevé 29 (RL-29) | Amounts paid to persons responsible for a family-type resource or an intermediate resource |

| - | Relevé 31 (RL-31) | Information about a leased dwelling as of the end of the year. This is used by tenants and subtenants to claim the Solidarity tax credit |

If you have a refund coming to you, the quickest way to get your money is to sign up for direct deposit. Our software lets you sign up right from within the software, helping you get your refund from Revenu Québec that much faster.

Note: If you need a Revenu Québec My Account, but don’t have one, check out our help article for how to register for one.

Before you file your tax returns you can review:

- Summaries of both your CRA and Revenu Québec returns

- Detailed PDFs of both your CRA and Revenu Québec returns (paid feature)

See Where do I find my PDF tax return? for details on where to look for your return summary in the software.

Once you’re ready to file your taxes, you will submit your CRA (T1 General Tax Return) and Revenu Québec (TP1 Québec Tax Return) returns separately.

If you are filing electronically, you’ll use NETFILE to transmit your CRA and Revenu Québec returns. Once submitted, you will receive confirmation numbers from both. We recommend that you keep these confirmation numbers for your records.

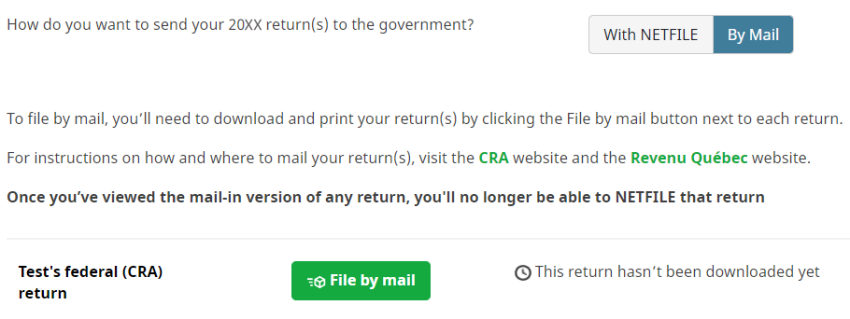

If you’ve decided to mail your returns instead of filing them electronically with NETFILE, go to the File tab to download PDF copies of your returns. You can then print and send them to your CRA and Revenu Québec tax centres:

Note: Keep in mind, once you’ve chosen to file your return by mail on the File tab, you can’t NETFILE your return.

For more information, check out our help article, Where do I find the mail-in version of my tax return (PDF)?.

All our products and services are built and supported by a team of tax professionals across Canada, including Québec. We understand that our Québec clients have unique tax scenarios that require customized language and calculations.

H&R Block tax software conveniently prepares both your federal and provincial returns at the same time and considers Québec-specific tax rates, tax brackets, and tax credits in its calculations. Not only is the software available in English and French, but you’ll also be able to access the following in both languages:

- Online Help Centre – full of easy-to-understand help articles that cover hundreds of different tax situations, credits, deductions, and other useful information

- General tax saving suggestions, customized tax tips (paid feature), and error messages for Québec returns

- Services such as our Audit protection and Expert review service