Moving expenses

If, in 2025, you moved at least 40 kilometres closer (by the shortest usual public route) to a new location to work, to run a business, or to take courses as a full-time student in a post-secondary program, you might be able to claim a moving expenses deduction on the T1-M: Moving Expenses Deduction form.

Note: If you’re filing a Québec return, you’ll also need to complete the TP-348-V: Moving Expenses form. Fortunately, both the T1-M and TP-348-V forms are combined in H&R Block’s tax software.

If you’re employed or self-employed, you can deduct moving expenses only if you’ve earned employment or self-employment income at the new location. You can’t deduct these expenses from any other type of income such as investment or employment insurance benefits, even if these were received at your new location.

Note: If you received a reimbursement or an allowance for your moving expenses you can only claim these expenses if:

- you include the amount you received in your income or

- you reduce your moving expenses by the amount received

To claim your moving expenses, you’ll need to enter your net eligible income on the moving expenses form. If you’re an employee, your net eligible income is your employment income (from your T4 and/or T4A slips) that you earned at the new work location less any deductions (RPP, union dues, employment expenses, clergy residence, or income amounts repaid) you claimed on your return.

If you’re self-employed, your net eligible income is net self-employment income earned at the new work location less any deductions (union and professional dues, and deduction for CPP/QPP contributions) claimed on your return.

If you’re a Québec resident, you can only claim moving expenses from the net income you earned in the tax year at the new place of work.

As a full-time student, you can claim moving expenses paid at the beginning of each academic period as long as you meet the 40-kilometre requirement and you earned income at your new location. You can only deduct these expenses from the part of your scholarships, fellowships, bursaries, fellowships, research grants, and/or certain prizes that are required to be included in your income. This is also known as your net income amount.

Note: If you’re a Québec resident, your net income is the net amount of any research grants you received.

If you’re a co-op student, you can also claim your moving expenses when you move back after a summer break or a work semester, as long as you meet the distance and earned income requirements.

You can claim the cost of reasonable expenses you paid to move yourself and your family to your new home. Common eligible moving expenses include:

- Transportation and storage costs such as packing, hauling, hiring movers, in-transit storage, and insurance

- Travel expenses such as vehicle expenses, accommodation, and reasonable amounts for meals that you paid during the moving process for yourself and your family

- Cost of cancelling a lease for your old home

- Cost to maintain your old home such as interest, property taxes, insurance premiums and the cost of heating and utilities (up to $5,000) after you moved and while you made reasonable efforts to sell the home

Note: You or another person in your family can’t live in the old home nor can it be rented to any other person while you’re trying to sell it.

- Cost of selling your old home including advertising, notary or legal fees, real estate commission, and mortgage penalty when the mortgage is paid off before maturity

- Cost of purchasing your new home, if you or your spouse or common-law partner sold your old home because of your move

- Incidental costs for changing your address on legal documents, replacing your driving licences, and connecting and disconnecting utilities

If you had to live somewhere else because you sold your home before your move or you had to wait for your new home to be ready after your move, you can also claim temporary living expenses for up to 15 days. These expenses include the cost of accommodation and meals for you and your family.

You can either use the simplified method or the detailed method to claim your meal and vehicle expenses. The simplified method allows you to use a flat kilometre rate based on the province/territory you’re moving from and a flat rate per meal per day, for three meals. The detailed method requires that you use the amounts shown on all your receipts.

Make sure you keep all of your receipts in case the Canada Revenue Agency (CRA) asks to see them.

If your moving expenses are more than the income you earned (including scholarships) at your new location, you can carry forward all or part of your moving expenses. This means you can deduct the carried forward amount from the same type of income in a future tax year to lower your tax payable.

Note: If you move again before claiming your carry forward amount, any moving expenses you didn’t claim previously will be lost.

Example 1: Anna moved 200 km to be closer to her new job in November 2025 and paid $10,000 to move herself and her family. However, she only earned $6,000 at her new work location for the year. For 2025, she can only claim $6,000 in moving expenses and can carry forward the remaining $4,000 ($10,000 minus $6,000). Anna will be able to claim the $4,000 from her employment income at the new location in 2026, as long as she earns more than $4,000.

Example 2: Anna moved 200 km to be closer to her new job in December 2025 and paid $10,000 to move herself and her family. However, she only started working at her new job on 2 January 2026. She won’t be able to claim any moving expenses on her 2025 return but will she will be able to claim them on her 2026 return against her employment income for the year at the new location.

If you have unused moving expenses from prior years, you can find the amount on line 24 of your 2024 T1-M form or on line 18 of your 2024 TP-348 form, if you’re a Québec resident.

Follow these steps in H&R Block’s 2025 tax software:

-

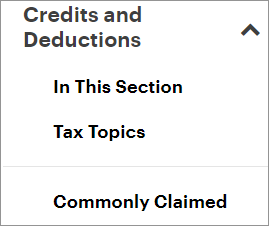

On the left navigation menu, click the Credits & deductions tab and then, the Commonly Claimed heading.

- Under the DEDUCTIONS heading, select the checkbox labelled Moving expenses and click Continue.

- When you arrive at the Moving expenses page, enter your information into the tax software.