Dependant Expenses

Generally speaking, a dependant is someone that lives with you and relies on you for care and support on a daily basis.

For most, dependants are typically under the age of 18. However, a dependant can also be someone over the age of 18 that suffers from a physical or mental impairment and who is completely dependent on your support.

According to the Canada Revenue Agency (CRA), a dependant must be related to you by blood, marriage, common-law partnership, or by adoption. This person can be your or your spouse’s or common-law partner’s:

- Child

- Grandchild

- Parent

- Grandparent

- Brother or sister

- Niece or nephew

- Aunt or uncle

Based on your dependant’s age and eligibility, you might be able to claim the following dependant deductions and credits.

Note: Even if you’re claiming someone as a dependant, he or she might still have to file their own tax return. For example, if your dependant is eligible for the disability tax credit, he or she has to first claim that tax credit on their return to reduce their tax payable to zero. Any unused disability amount can then be transferred to you (as long as you’re the person named on their T2201 form).

If you paid to have your child (under the age of 16) looked after so that you can go to work, carry on a business, conduct research or similar work, or go to school, you can claim the amount you paid for Child care expenses.

Note: If your child suffers from a physical or mental impairment and is dependant on your and/or your spouse for care, the age limit doesn’t apply.

You can claim the expenses you paid to adopt a child under the age of 18. You can only claim these expenses in the tax year that includes the end of the adoption period for your child. For more information on eligibility requirements and qualifying expenses, refer to our Adoption expenses article.

If your child is over the age of 18, you can’t claim them as a dependant unless they are suffering from a physical or mental impairment. However, if your child is enrolled in a university or college, your child can transfer up to $5,000 of Tuition tax credit to you.

You can claim medical expenses you paid in any 12-month period ending in 2024 for your dependants (as long as you haven’t claimed them before).

If you’re claiming medical expenses for yourself, your spouse or common-law partner, or your child under the age of 18, refer to our Medical expenses article for more information.

If you’re claiming medical expenses for other dependants, refer to our Claiming your dependant's medical expenses article for more information.

As a single person, if you financially support a dependant, you can claim the amount for an eligible dependant on your tax return. The amount you can claim is reduced by your dependant’s net income. Additionally, only one person in the household can make this claim regardless of the number of dependants in the house. Keep in mind, you also won’t be able to claim this amount if you’re claiming the amount for a spouse or common-law partner.

You can claim the Canada caregiver credit if you took care of any of the following dependants with a physical or mental impairment:

- Your spouse or common-law partner

- Your or your spouse’s or common-law partner’s child or grandchild

- Your or your spouse’s or common-law partner’s parent, grandparent, brother or sister, uncle or aunt, niece or nephew (if they lived in Canada at any time during the year)

Note: Under the federalCanada caregiver credit, you can no longer claim your or your spouse’s parent or grandparent if they don’t have a physical or mental impairment, even if they are living with you. However, some provinces have a caregiver amount under which you might be able to claim a parent or grandparent (yours or your spouse’s), who is dependant on you for support even if they are not infirm. Refer to the CRA website to see if you can claim an elderly dependant under your province’s caregiver amount (if applicable).

If your dependant (other than your spouse or common-law partner) is eligible

to claim the Disability amount and

doesn’t need to claim the entire amount on their return to reduce their

taxes, you might be able to use this remaining amount to

lower your own tax payable. If your dependant has an approved

Many of the above deductions and credits also have a corresponding provincial or territorial tax credit. For example, if you live in Ontario and are eligible to claim your federal amount for adoption expenses, you might be able to claim a provincial tax credit for the same expenses.

In other cases, where federal deductions have been eliminated (such as the children’s fitness and arts amounts or the education and textbook amounts), certain provinces have kept the corresponding provincial/territorial tax credit. For example, residents of British Columbia, Manitoba, and the Yukon can still claim the children’s fitness and arts amounts.

Refer to the CRA website for more information on which provincial deductions and credits you can claim for your dependant(s).

If you’re a resident of Québec, you might also be able to claim the following additional tax credits for your dependant(s):

Follow these steps in H&R Block’s 2024 tax software:

Before you begin, make sure that you’ve told us about your dependants.

-

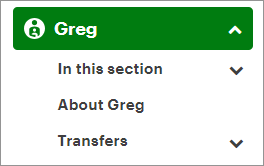

On the left-navigation menu, click the name of your dependant.

-

Select the dependant expenses or credits that apply to you then click Continue.

- When you arrive at the page for the expense or credit you’re claiming, enter your information into the tax software.

Note: Depending on the information you enter in the tax software, some of the amounts may be calculated and claimed automatically for you. You will be able to see these amounts and optimize them (if applicable) under Final Review on the Wrap-Up tab .