Claiming the adoption expenses tax credit

As an adoptive parent of a child under 18 years of age, you can claim a tax credit for your adoption expenses to help with the cost of adopting a child.

For tax year 2025, the maximum claimable amount for each child is $19,580. To qualify for this tax credit, the expenses you paid must fall into one of the following categories:

- Fees* you paid to a licensed adoption agency

- Legal fees, court costs, and administrative expenses related to the adoption order

- Reasonable and necessary travel and living expenses for you, your spouse or common-law partner, and for the child

- Document translation fees

- Mandatory fees paid to a foreign institution

- Expenses paid for the child's immigration and

- Other reasonable expenses related to the adoption required by a provincial or territorial government or an adoption agency

*These fees can include any of the following and can vary from one agency to another:

- Administration fees

- Home study fees

- Fixed agency fees

- Professional services for adoptive parents (including counseling and education preparation for the adoption of a child)

- Investigative expenses (for example, criminal background checks)

The adoption expenses must have been paid during the

Note: You can’t claim any expenses that you paid after the end of the adoption period nor for which you received a reimbursement or financial assistance.

You can split the adoption expenses amount in any way with your spouse or common-law partner on your returns, provided the total is not more than the federal maximum claimable amount of $19,580.

If you’re a resident of Alberta, Manitoba, Newfoundland and Labrador, or Ontario, you and the other adoptive parent can choose to split your provincial claim for adoption expenses as long as the combined amount isn’t more than the maximum claimable amount for the year.

If you’re a resident of one of the following provinces, you can also claim a provincial credit for adoption expenses:

Note: To claim the provincial amount, you must meet the requirements for claiming the federal adoption expenses in the section above.

Click here for more information on the provincial and territorial adoption tax credits.

If you were a Québec resident on December 31, you can claim 50% of the eligible adoption expenses you paid, up to a maximum of $10,000 per child, as long as:

- You received an adoption judgment in 2025 from a Québec court (or an adoption judgement that received legal recognition in Québec in 2025), that establishes a relationship between you and/or your spouse and the child or

- You received a certificate of compliance with the Convention on Protection of Children and Co-operation in Respect of Intercountry Adoption in 2025

You can claim your adoption expenses on the TP-1029.8.63-V: Tax credit for adoption expenses form. Remember, only the adoption expenses you paid for after an adoption file was opened by the Minister of Health and Social Services or an agency certified by the Minister, are claimable.

Follow these steps in H&R Block's 2025 tax software:

Before you begin, make sure that you have told us about the dependants, for whom you will be claiming the adoption expenses.

-

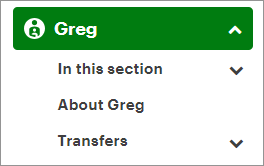

On the left-navigation menu, click the name of your dependant.

- Under About {dependant name}, select the checkbox for Adoption expenses and click Continue.

- When you arrive at the page for Adoption expenses, enter your information into the tax software.