Disability amount transferred from a dependant

If one of your dependants (other than your spouse or common-law partner) is eligible

to claim the disability amount

and doesn’t need to claim the entire amount on their return to reduce their taxes,

you might be able to

use this remaining amount

to lower your own tax payable. If your dependant has an approved

You can claim your dependant’s disability amount if:

- Your dependant was resident in Canada at any time during the year

- Your dependant relied on you for all or some of the necessities of life (like food, shelter, or clothing) and

-

One of the following conditions are met:

- You claimed an amount for an eligible dependant for this person (or could have if you didn’t have a spouse and if the dependant didn’t have income) or

- The dependant was your or your spouse’s parent, grandparent, child, grandchild, brother, sister, uncle, aunt, niece, or nephew and you claimed the Canada caregiver credit for them (or could have if he or she didn’t have income and was 18 years or older in the year)

There are certain situations in

which you can’t claim the disability amount of a dependant. For complete details,

refer to the

Note: If the CRA doesn’t have an approved T2201 on file for your dependant, you won’t be able to NETFILE your return. Instead, you’ll have to file a paper return and attach a completed T2201.

Tax tip: If your dependant is under the age of 18, you might also be able to claim a supplemental amount on their behalf.

If you’re a resident of Québec, you'll need to submit a completed Certificate Respecting an impairment (TP-752.0.14) form to Revenu Québec to certify that your dependant, for whom you are claiming a tax credit in your return, has a severe and prolonged impairment. However, if you have an approved federal T2201 for your dependant, you can send a copy of that instead.

Remember, if you’re eligible to claim the federal disability amount transferred from a dependant, you’re also entitled to claim a corresponding provincial tax credit, which might vary in amount depending on which province or territory you live in:

Yes – but you will have to paper file. Attach a note to your paper return that includes the personal information (name and SIN) of the other supporting person that’s claiming this amount. Remember though that the total claimed between the two of you for that dependant can’t be more than the maximum allowed.

Follow these steps in H&R Block’s 2025 tax software:

Before you begin, make sure that you’ve told us about the dependant(s) from whom you’ll be transferring the disability amount.

-

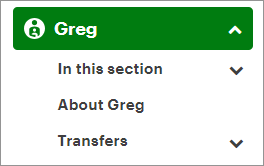

On the left-navigation menu, click the name of your dependant.

-

Under the Transfer amounts heading, select the checkbox

labelled Disability amount, then click Continue.

-

When you arrive at the Disability amount page, answer

the questions to find out if you’re eligible to claim your dependant’s

disability amount. Once confirmed, enter your information into the tax

software.

-

Click the Wrap-Uptab and navigate to Final Review.

- If you indicated that your marital status is single, divorced, separated, widowed, or if you’re preparing your return separate from your spouse, on the Claimed Credits page, select from the drop-down who will claim the disability amount transferred from a dependant.

- If you're preparing your return with your spouse’s return, on the Optimized Credits page, select from the drop-down who will claim the disability amount transferred from a dependant.