Interest from a bank account

Interest from a bank account is usually taxable income and you have to report it on your return. If your interest income is over $50, you’ll receive a T5 slip (and an RL-3 if you’re in Québec) from your bank. You might not get a tax slip if your interest income was less than $50, but you’ll still need to report this income on your return.

Here’s how you can enter your bank interest on your return in H&R Block’s tax software:

If you received a T5 and/or an RL-3 slip for interest from your bank account, follow these steps to enter information from the slip into the tax software.

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type T5 into the search field. Click the highlighted selection or press Enter to continue.

- When you arrive at the T5 page, enter your information as it appears on the slip into the tax software.

Note: Follow the same steps to enter information from your RL-3 slip.

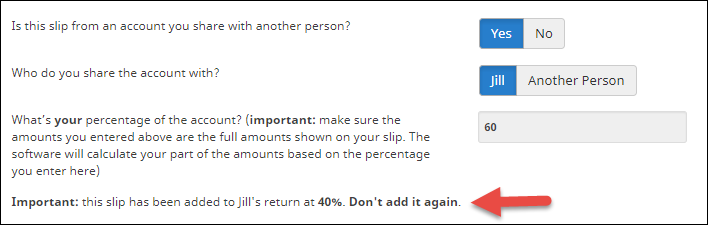

If this slip is for an account you hold with another person (joint account), you’ll be able to split this slip with the other person by indicating what percentage of the account is yours. For example, on the T5 page, you’ll see related questions under the Additional information about your slip section.

H&R Block’s tax software will automatically split the amounts you enter based on how much of the account is yours. Refer to our help article What is slip splitting and how does it work? for more information.

If you earned interest from a bank account but did not receive a tax slip (such as a T5), complete the Statement of investment income, carrying charges, and interest expenses page in H&R Block’s tax software. Here’s how:

Important: Make sure that you don’t enter any amounts on this page from slips you have already entered in your return. Re-entering amounts from your slips on this page will result in inaccurate income and/or deduction amounts.

-

On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

-

Select the Investment income & expenses checkbox.

-

At the bottom of the page, click Add selected topics to my return.

- Under the INVESTMENT INCOME heading, select the checkbox labelled Statement of investment income, carrying charges, and interest expenses. Québec residents will see this page as Statement of investment income and adjustment of investment expenses (federal worksheet & Schedule N).

- Once you get to this page, enter the bank interest amount in the Interest and other investment income section.

Note: Make sure you enter the full interest amount received from this bank account, even if it is a joint account. If this interest is from a bank account you share with another person (joint account), you’ll be able to indicate how much of this interest amount is the other person’s share by following these steps:

- Once you’ve entered the bank interest amount on the Statement of investment income, carrying charges, and interest expenses page, click Required on the left navigation menu under Credits & deductions.

- Click the CRA questions link (or CRA/Revenu Québec questions, if you’re in Québec).

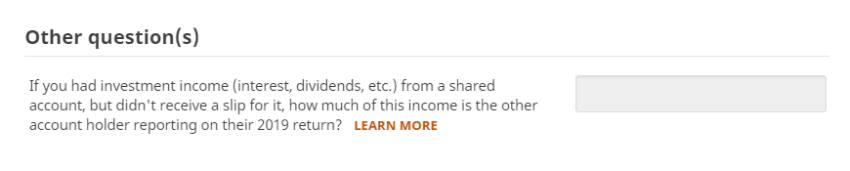

- Scroll to the bottom of the page and under Other question(s), enter the amount of interest the other joint account holder is reporting on their return.