Relevé 3: Investment income (RL-3)

You’ll receive a Relevé 3: Investment income (RL-3) slip if you’re a resident of Québec and, in 2025, you earned at least $50 from one or more of the following sources:

- Interest

- Dividends

- Capital gains dividends

- Royalties

Note: If the amounts shown on your paper RL-3 slip are displayed in a foreign currency, you’ll need to convert them to Canadian dollars before you report this income on your return. If you received foreign income throughout the year, use the average annual rate; otherwise, you can use the monthly and daily rates provided by the Bank of Canada.

In addition to an RL-3, you’ll also receive a T5: Statement of investment income slip which you’ll use to complete your federal return.

Important: Even if you earned less than $50 from one of the income sources mentioned above, it’s still your responsibility to report these amounts on your return. This includes any interest shown on the notice of assessment (NOA) you received from Revenu Québec.

If you have an amount in box H of your RL-3 slip, this means you received royalties from an organization in Canada during the year. Royalties are compensation for using or allowing the use of a copyright, patent, trademark, formula, a secret process, or are payments related to cinematic films, film works, music, books, or television tapes that you created.

Generally, if your royalties are from a work or invention of yours and you don’t have any associated expenses, these are considered employment income. If there were associated expenses, your royalties will be considered business income.

Follow these steps in H&R Block's tax software to file your 2025 taxes:

-

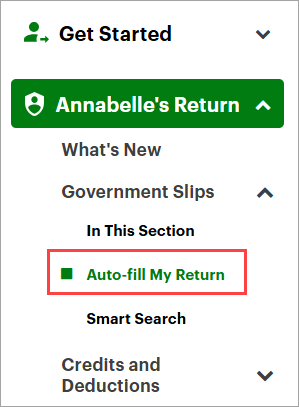

On the left navigation menu, click the Government slips tab, then Auto-fill your return.

- Type RL-3 into the search field. Click the highlighted selection or press Enter to continue.

- When you arrive at the RL-3 page, enter your information into the tax software.