What is slip splitting and how does that work?

If you received an information slip (such as a T5) for an account you shared with your spouse or common-law partner (or another person), you'll need to indicate on your return who you shared this account with and your share of contributions to that account. This “splitting” of the slip ensures that amounts on the slip are accurately allocated to each person who held the account.

The following slips can be split in H&R Block’s 2025 tax software with the person who shared the account with you:

- T3: Statement of trust income allocations and designations

- T5: Statement of investment income

- T5008: Statement of securities transactions

- RL-3: Investment income (Québec only)

- RL-16: Trust income (Québec only)

- RL-18: Securities transactions (Québec only)

H&R Block’s 2025 tax software makes it easy for you to split your slip with your spouse or another person. Before you start, remember to enter the information from your slip into the tax software as is (in other words, enter the entire amount you see on your slip into the software). H&R Block’s tax software will automatically split the amounts you enter based on how much (what percentage) of the account is yours (you’ll also enter this percentage into the software).

For example, to split the amount shown on your T5:

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type T5 into the search field. Click the highlighted selection or press Enter to continue.

- When you arrive at the T5 page, enter your information into the tax software. REMEMBER to enter the amount exactly as it appears on your slip!

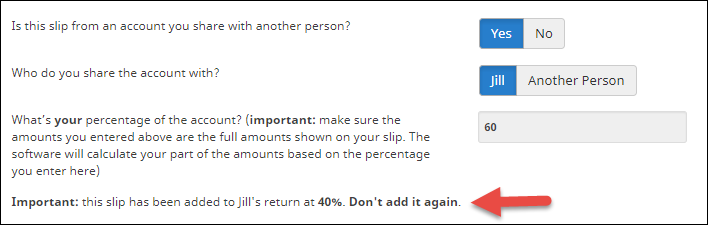

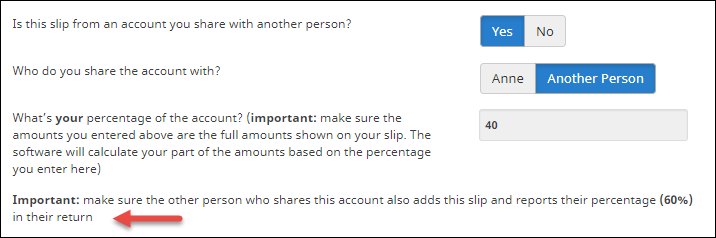

- Under the Additional information about your slip section, select Yes to the question Is this slip from an account you share with another person?.

- Select the person with whom you share the account with and enter your percentage of the account in the designated field.

Note:

- If you accidentally indicated that your slip was for an account you shared with another person and want to change this, simply go back to the slip page in your return, and answer No to the question Is this slip from an account you share with another person?.

- If you’re preparing your return with your spouse and the information slip is shared between the both of you, you’ll only need to enter the slip into H&R Block’s tax software once – you don’t need to add it again (through Auto-fill My Return (AFR) or on the Smart Search page). The software will automatically add the slip to your spouse’s return based on his or her percentage of the account.

- If you delete the slip from your return, the software will also delete the slip from your spouse’s return.

- The percentage fields on the your and your spouse's slip pages are linked. If you edit the percentage in one return, the software will automatically adjust the percentage in the other spouse’s return as well.

- If you’re not preparing your return with your spouse or you shared the account with another person, be sure to remind them to add the slip to their return and report their percentage of the account.