What is Anomaly Detection?

Anomaly Detection is a diagnosis notification available to all clients. It allows you to analyze your return against 250,000 other returns from the CRA or Revenue Québec before NETFILING.

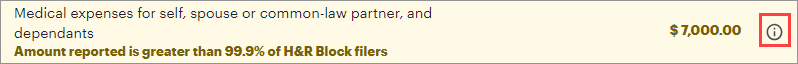

This feature looks for anything that might be an outlier and notifies you about numbers that may have been accidentally entered. There are cases where an anomaly may be detected, however the information is correct. If so, this encourages you to save your documents in case of an audit.

Having an anomaly does not mean you will get audited. However, there is a higher risk associated with getting an anomaly. If you are concerned and want to be confident about your return, we recommend getting either Expert Help (Request a Call or Book an Appointment) or Audit Protection.

What does this Anomaly Alert mean?

The following anomaly alerts are shown to either inform you to review or correct the information. Find a description of each alert below:

Note: In all situations, we recommend holding on to all your documents for 7 years because the CRA or Revenue Québec may reassess your return in the future.

| Anomaly Alerts | Description |

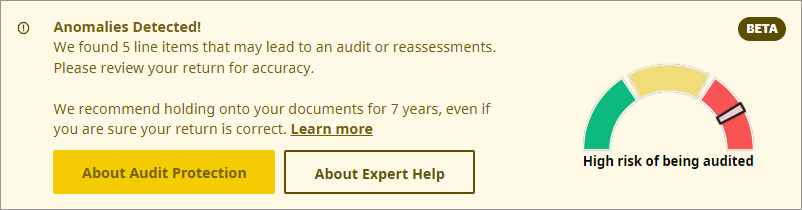

| Red |

The arrow in red indicates you may be at a higher risk of being audited. Below the status, sources of concern that may lead to an audit or reassessment of your return are listed.

Review and correct any warnings before continuing. If you want to find more information about the anomaly, you can hover your cursor over the anomaly tooltip.

|

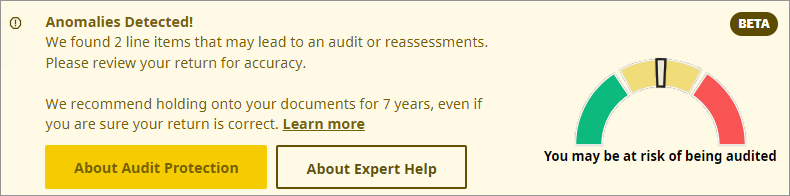

| Yellow |

The arrow in yellow suggests you may be at risk of being audited. Below the status, sources of concern that may lead to an audit or reassessment of your return are listed.

Review and correct any warnings before continuing. If you want to find more information about the anomaly, you can hover your cursor over the anomaly tooltip.

|

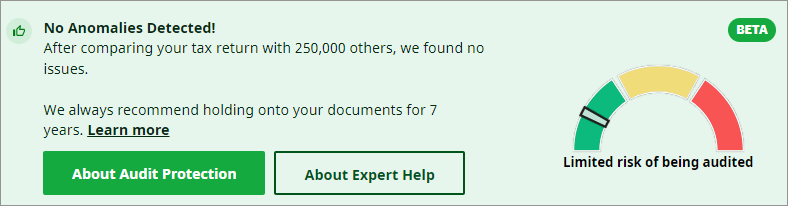

| Green |

The arrow in green means no concerns were found on your return.

|