Schedule J: Québec tax credit for home-support services for seniors

If you or your spouse or common-law partner is 70 or older, needs home-support services (such as help with eating, bathing, moving around within your home, and maintaining your home) in order to continue living comfortably at home, you might be able to claim the Québec tax credit for home-support services for seniors, even if you didn’t have any income in the year.

To be eligible for this credit, you must meet the following conditions:

- You must be at least 70 years of age on December 31, 2025

- You must be a resident of Québec on December 31, 2025

Note: If you turned 70 in 2025, you can only deduct the expenses you paid for after you turned 70. If your spouse is also eligible for this credit, only one of you can claim the credit for the couple (complete only one Schedule J in your H&R Block tax return).

To claim this tax credit, you can:

- Complete Schedule J when you file your tax return or

- Apply online (by December 1st) to receive advanced payments

Note: If you miss the advance payment application deadline, you’ll have to wait until you file your return to claim the tax credit.

Generally, the tax credit amount will be the same whether you claim the credit on your return or choose to receive advance payments. However, even if you received advance payments during the year, you should still complete a Schedule J when you file your return to make sure you’ve received the amount you’re entitled to. Keep in mind, the person who receives the advance payments should be the one to claim the credit.

Note: Advance payments are only received through direct deposit.

If you receive advanced payments and there are any changes in your situation, you’ll need to inform Revenu Québec immediately.

You can claim 35% of your expenses (up to a maximum of $19,500 in eligible expenses for a single person). However, the amount you can claim changes based on:

- If you’re a person living alone, a dependant senior, or a couple

- The type of dwelling (house, condominium, apartment building, health establishment, private seniors’ residence) you live in

- Your net family income

Visit the Revenu Québec website for more information on the amount you can claim based on your living circumstances.

As a dependant senior, you must need constant supervision because of a severe mental disorder with an irreversible breakdown in thought activity, or must need help from others with your personal care for a prolonged and indefinite period of time. You might be required to provide the Certification of Dependent Senior Status form as confirmation from your doctor.

The home-support services that are eligible for this tax credit depend on what type of residence you live in. If, for example, you live in a certified private seniors’ residence, you can claim the eligible regular services that are included in your rent (housekeeping, laundry, etc.) provided these are listed in your lease.

You might also be able to claim the tax credit for several occasional home-support services (these are services that you pay for each time you use them or those that are provided under a contract). These services include:

- Help with dressing

- Help with taking a bath

- Help with eating and drinking

- Meal preparation and delivery by a non-profit community organization

- Care provided by a nurse or nursing assistant

This list is not complete. For more information, refer to Revenu Québec’s Tax Credit for Home-Support Services for Seniors Guide.

While the term “housekeeping” might imply that any service relating to your home is eligible, Revenu Québec only considers the following housekeeping services eligible for this credit:

- Sweeping, dusting, and cleaning living areas

- Maintaining appliances (for example, cleaning the oven or refrigerator)

- Cleaning rugs and upholstered furniture (sofas and armchairs)

- Cleaning air ducts and

- Chimney sweeping

Unfortunately, housekeeping services don’t include the cost of cleaning supplies.

As the name implies, nursing services include the care provided by either a nurse, or a nurse’s assistant. To qualify for the tax credit for home-support for seniors, the amount you paid for nursing services can’t be included in any amount that you’re claiming as a medical expense.

When claiming the tax credit for home-support services for seniors, personal care services related to the following are eligible:

- Dressing

- Personal hygiene (for example, help with bathing)

- Mobility in the home and

- Eating and drinking

The following is a list of services that you can claim which might not be included in your rent or condo fees:

Housekeeping services

- Sweeping, dusting, and cleaning living areas

- Maintaining appliances (for example, cleaning the oven or refrigerator)

- Cleaning rugs and upholstered furniture (sofas and armchairs)

- Cleaning air ducts and

- Chimney sweeping

You can also claim the cost of these services if you live in your own house.

Grounds maintenance

- Lawn care (fertilization and mowing)

- Pool maintenance

- Hedge trimming and plant-bed maintenance

- Tree pruning and

- Raking leaves

Unfortunately, the cost of maintaining the equipment used to maintain the grounds aren’t eligible for this credit. For more examples of which services don’t qualify for this credit, refer to Revenu Québec’s Income Tax Return Guide.

Note: If you or your spouse received (or is entitled to receive) a partial reimbursement for the cost of the services you’re claiming on your return, you can only claim the amounts that you’ve actually paid.

Example:

In 2025, Pat spent $1,000 on eligible housekeeping services. Through a government-sponsored program, she received a reimbursement of $250 to help cover the cost of this service. This means that when completing Schedule J in H&R Block’s tax software, she can only claim $750 ($1,000 - $250).

If you received financial assistance in a form other than a government reimbursement and you don’t have to report how this money is spent (as would be the case if you qualified for the shelter allowance program), you can claim the cost of the eligible service in full.

For more information, check out the Revenu Québec Income Tax Return Guide.

For the purposes of this credit, meal delivery services by a community organization include:

- Meal preparation and delivery by a non-profit community organization (like Meals on Wheels) or

- Help preparing meals in your own home

Depending on your situation, you might be able to claim the cost of certain additional services on your return such as:

- Supervision and support services (this includes non-specialized night supervision, monitoring, and companion sitting, or services related to the use of a personal GPS locator*)

- Civic support services (this includes help going to vote and help completing forms and applications)

- Laundry services (this includes the care of your clothing and household linens) and

- Supplying necessities and running other errands (this includes grocery and prescription drug delivery)

*While the cost to rent or buy this kind of device is not considered an eligible expense, you might be able to claim a portion of the cost if you’re also claiming the independent living tax credit for seniors. Refer to Revenu Québec’s Income Tax Return Guide for more information.

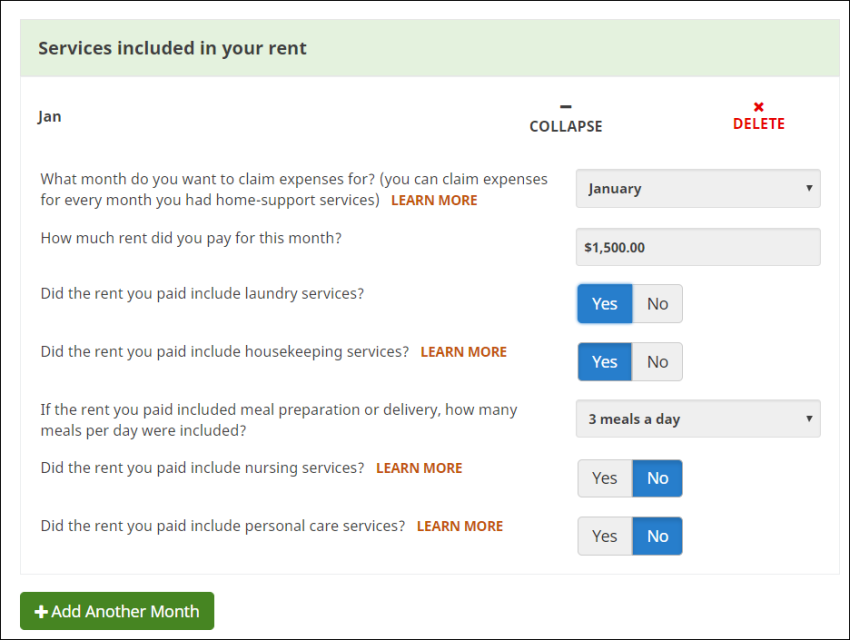

If the home-support services you received were included in your rent, you’ll

need to indicate which months during the year you received them when completing

your return. For example, let’s say your rent for January included laundry

and housekeeping services only. Here’s how your entry might look on the Schedule J page

in H&R Block’s tax software:

If you received these services as part of your rent throughout the year, simply click the +Add Another Month button and repeat the entry for the months February to December.

If you lived in a residential complex (such as a condominium) and paid fees during the year that included the cost of eligible services, for which you can claim the tax credit for home-support services for seniors, you can ask the building’s syndicate of co-owners to complete form TPZ-1029.MD.5-V.You’ll need to enter information from your TPZ-1029.MD.5-V form into the TPZ-1029.MD.5-V page in H&R Block’s tax software. To do this, follow these steps:

Before you begin, make sure that you’ve told us that you lived in Québec on December 31, 2025.

- On the left navigation menu, under the Credits & deductions tab, click Other.

-

Under the CREDITS FOR SENIORS heading, select the checkbox labelled Tax credit for home-support services for seniors (TPZ-1029.MD.5-V).

- When you arrive at the page for the Tax credit for home-support services for seniors, enter your information into the tax software.

Follow these steps in H&R Block's 2025 tax software :

Before you begin, make sure that you’ve told us that you lived in Québec on December 31, 2025.

- On the left navigation menu, under the Credits & deductions tab, click Other.

-

Under the CREDITS FOR SENIORS heading, select

the checkbox labelled Tax credit for home-support services for seniors (Schedule J), then click Continue.

- When you arrive at the page for the Tax credit for home-support services for seniors, enter your information into the tax software.

Note: If you lived in a condo and have a completed TPZ-1029.MD.5-V form from your building’s syndicate of co-owners, you’ll need to enter information from that form into the TPZ-1029.MD.5-V page in the software.