About your mailing address

Your current mailing address is needed to ensure that the Canada Revenue Agency (CRA) and Revenu Québec (if applicable) are able to send you important documents and/or benefit payments correctly and on time. If you moved during 2025 and haven’t updated your mailing address with the CRA and/or Revenu Québec, refer to our help article on how you can do this.

Your mailing address does not have any bearing on which jurisdiction you will pay taxes to. It is simply the most convenient address for you to receive your mail from the government.

Important: To determine which tax package to complete, you will be asked to enter your province of residence on December 31, 2025 on the Your residence page in the tax software.

When entering your mailing address, the Canada Revenue Agency (CRA) only allows the use of certain special characters in the City field (such as an apostrophe, period, space, slash, or hyphen).

Generally, your address can’t start and/or end with special characters (except a period, which is valid anywhere except at the beginning). In addition, only certain combinations of special characters are allowed. For example, a slash (/) can’t be entered next to other special characters. Double space is also not allowed.

Correct City format: St. John’s, St John’s, St.-John’s, Val-d’Or, Chatham-Kent,

Incorrect City format: St./John’s, Chatham&Kent

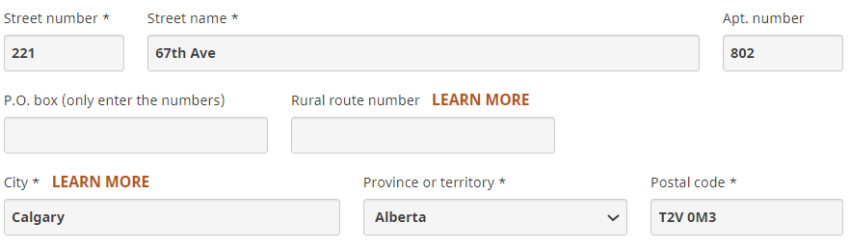

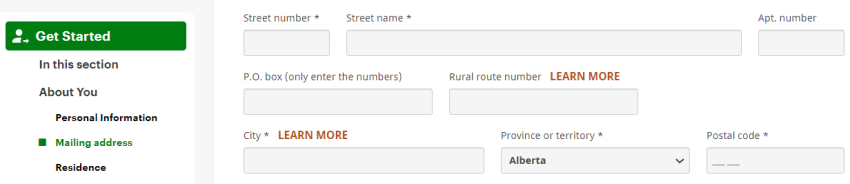

Not sure how to enter your mailing address? Take a look at the examples below.

John Jones

221 67th Ave Apt. 802

Calgary, AB T2V 0M3

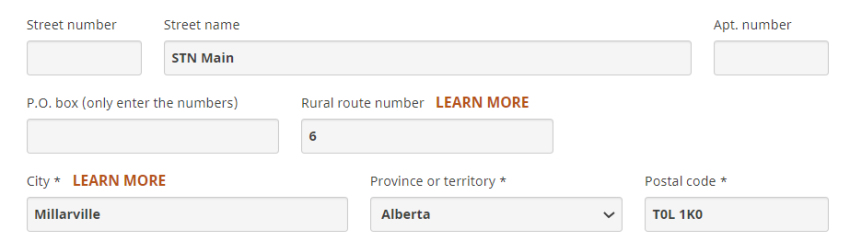

John Jones

RR 6 STN Main

Millarville, AB T0L 1K0

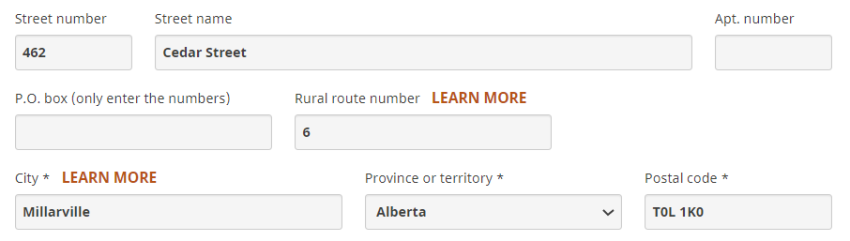

John Jones

462 Cedar Street

RR 6 STN Main

Millarville, AB T0L 1K0

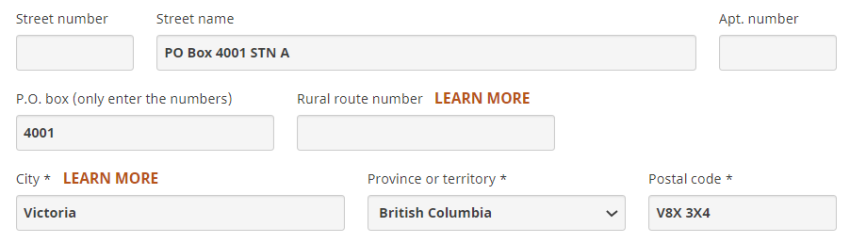

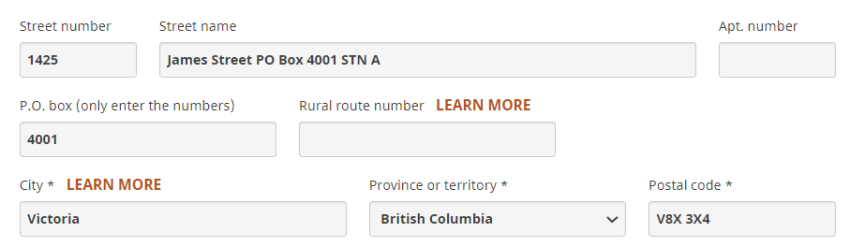

If you’re entering a P.O. box number, be sure to only enter the numbers in the designated field on this page. For example:

Correct format: 99

Incorrect format: PO99, PO Box 99

John Jones

PO Box 4001 STN A

Victoria, BC V8X 3X4

John Jones

1425 James Street

PO Box 4001 STN A

Victoria, BC V8X 3X4

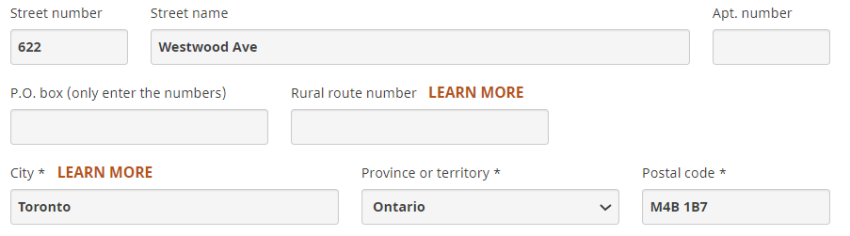

John Jones

622 Westwood Ave

Toronto, ON M4B 1B7

You can use the Street name field on the Mailing address page to enter your address, as long as you enter your Suburban Street (SS) number in the Street number field as well.

If you have a rural route (RR) address and don’t have a street address, you might see an error in H&R Block’s 2025 tax software asking you to enter details in the Street number and Street name fields on the Mailing address page. This error won’t prevent you from filing your return. If you’ve entered your address correctly, you can ignore this error and continue to prepare your return.

While this error won’t prevent you from filing your return, if you have any additional address information to add (such as site or station information), you can add that to the Street number and Street name fields to fix this error.

In order to NETFILE your return, you need to have a Canadian mailing address. International/United States addresses are not supported in H&R Block’s 2025 tax software.

- Error message 417 (H&R Block Online help centre)