Did your mailing address change this year?

If you and/or your spouse or common-law partner moved during the year, you’ll need to update your mailing address with the Canada Revenue Agency (CRA) before you file your tax return. If you don’t, the old mailing address on file for you and/or your spouse will be used and you might not get certain documents or benefit payments on time.

► If you moved and have already changed your mailing address with the CRA, answer No to this question in the software.

► If you moved and have not changed your address with the CRA, answer Yes to this question in the software.

Note: You can't change your or your spouse’s mailing address using NETFILE when you file your or your spouse's federal tax return. If you’re a Québec resident, you can update your mailing address when you NETFILE your return, provided you have your previous year’s notice of assessment (NOA) number. Refer to the Changing your address with Revenu Québec section below for more information.

Your mailing address is strictly for the purposes of communication by mail from the CRA or Revenu Québec. It does not relate to which tax package you will complete. To determine which tax package to complete, you will be asked to enter your province or territory of residency on December 31, 2025, on the Your Place of Residence on December 31, 2023 page in the tax software.

If you moved outside of Canada and are considered a deemed resident or a non-resident of Canada, you won’t be able to NETFILE your return. Unfortunately, you also won’t be able to use H&R Block’s 2025 tax software to prepare your taxes.

If, however, as on December 31, you were working, travelling or vacationing, or going to school outside Canada, or were commuting daily or weekly from Canada to your place of work in the United States, and you maintained residential ties in Canada, you are considered a factual resident of Canada. You’ll need to file a return based on the province or territory you have residential ties in.

Note: In order to NETFILE your return, you need to have a Canadian mailing address. International addresses are not supported in H&R Block’s 2025 tax software.

There are several options you can use to update your information with the CRA:

- Log into the CRA’s My Account service (registration required) and click Change my address and phone number(s) under Related services

- Contact the CRA directly by calling 1-800-959-8281

- Mail or fax a completed RC325: Address change request form to your tax centre or

- Mail or fax a signed letter to the CRA that includes your social insurance number (SIN), new address, and moving date to your tax centre

Tax Tip: You can change someone else’s address at the same time as yours (for example, your spouse’s); simply include their name, SIN, and signature in the letter that you’re submitting.

You can update your mailing address with Revenu Québec by using one of following methods:

- Log into Revenu Québec’s My Account service (registration required) and click Change of Address

- Contact Revenu Québec directly by calling 1-800-267-6299 or

- If you have your previous year’s NOA number, you can update your mailing address when you NETFILE your return*

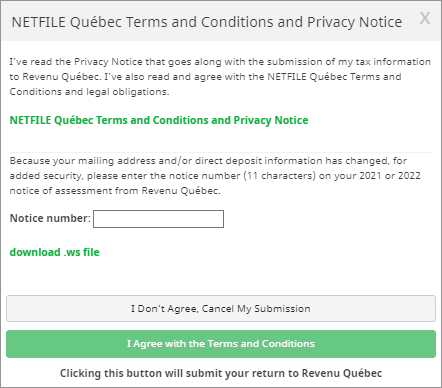

*In H&R Block’s tax software, you’ll be asked to enter your 2023 or 2024 Revenu Québec NOA number in the Notice number field when you NETFILE your Québec return. You’ll see this field if you indicated, on the page, that your mailing address changed during the year. This page can be found by navigating to Get Started on the left navigation menu, then .

Note: If, on your return, you indicate that your mailing address changed during the year but you don’t enter your NOA number, Revenu Québec will use the old mailing address they have on file for you.

Depending on your situation, it might be more convenient for you to receive mail and other correspondence at a location other than your home. For example, your mailing address is different than your home address if you choose to have your mail delivered to your place of work or the home of a family member or friend, rather than to your home.