Which employment expenses can I claim on my tax return?

You generally can’t deduct expenses you paid to go to work, such as the cost of travel to and from work, or most tools and clothing. However, you might be able to claim expenses you paid that were required for your job and were a condition of your employment. For example, if your job required you to travel for work, you might be able to claim vehicle expenses. See our help article on Statement of employment expenses for what you might be able to claim.

Still unsure about what expenses you can deduct? Let’s look at a few examples.

You can’t deduct a police background check or work clothes (uniforms etc.) required for your job. However, if you had employment income during the year you can claim the Canada Employment Amount, which could help you offset some of the cost. When you file your tax return with H&R Block, our tax software automatically claims this amount for you.

If you paid for training required for your job, such as First Aid certification, you can claim this cost on your tax return as a student expense as long as you have an

To claim training fees in H&R Block’s tax software:

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type T2202 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the T2202 page, enter your course fee(s) in box 26.

Note: If you’re filing your taxes in Québec, you’ll also need to enter your job-related training fees in box B on the RL-8 page in the software.

You can claim your annual dues if your job or profession requires you to maintain professional certification and the certifying body requires you pay annual dues.

- You, not your employer, must have paid the amount

- These organizations must be recognized by a Canadian, provincial, or foreign statute

As long as you have the receipt, you can claim the fees you paid to an educational institute to take an occupational, trade, or professional exam to obtain a licence or certification as a tradesperson or a professional status.

You cannot claim:

- Initiation/entrance fees, licences, special assessments, or charges for anything other than the organization's ordinary operating costs

- Dues paid before becoming a member of a professional organization

Annual union dues include:

- Annual membership dues for a trade union or an association of public servants

- Professional board, parity, or advisory committee dues required under provincial or territorial law

Note: Annual membership dues don’t include initiation fees, licences, special assessments, charges for pension plans as membership dues, or charges for anything other than the organization's ordinary operating costs.

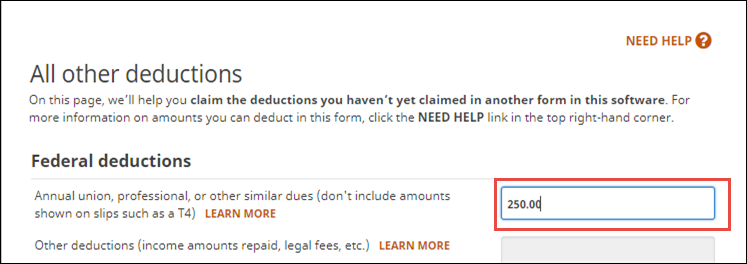

If you paid professional or union dues and your T4 or RL-1 slip doesn’t show the amount you paid, but you received a receipt from the organization you paid the dues to, enter this amount on the All other deductions page.

-

On the left navigation menu, under the Credits & deductions tab, click Other.

- Under the MISCELLANEOUS heading, select the checkbox labelled All other deductions, then click Continue.

- When you arrive at the All other deductions page, enter the amount you paid for professional or union dues shown on your receipt:

Note: If you’re a resident of Québec, H&R Block's tax software will automatically calculate your union or professional dues deduction for your Québec return, based on the amount you enter in this field.

- Employment Expenses (CRA website)

- Employment Expenses (IN-118-V) (Revenu Québec website)