What if I didn’t have income or all my income was tax exempt?

If you didn’t have any income in 2024 or if all your income was tax exempt, it is still in your best interest to file a tax return:

-

Parents: you might be eligible to receive certain tax credits and benefits such as the GST/HST credit or the Canada child benefit (and its related provincial/territorial benefit payment).

-

Post-secondary students: by filing a tax return, even if you didn’t have income in the year, you can carry forward certain tax credits (such as the tuition tax credit and interest paid on a student loan) to reduce your tax payable in a future year.

-

Adults over 19: you might be eligible to receive the GST/HST credit.

-

Seniors: you might be eligible to receive the GST/HST credit and split your pension income with your spouse or common-law partner.

Note: There are certain situations in which you must file a tax return. Refer to the Canada Revenue Agency (CRA) website for more information.

The income you earned during the year might be tax exempt if you’re an Indian (as described under the Indian Act) and your income was:

- earned on a reserve or

- from goods bought on or delivered to a reserve

Refer to the CRA website for more information relating to tax exemption and various income sources.

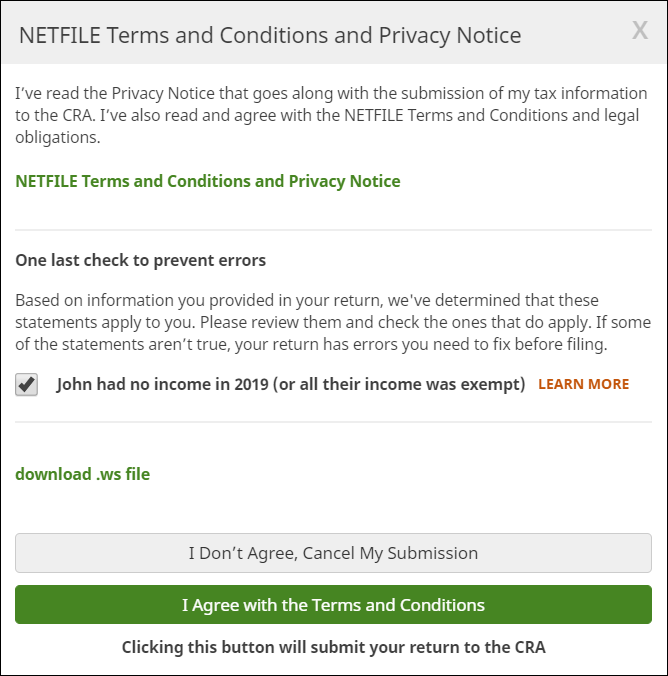

If you didn’t have any income this year or if your income was tax exempt, you’ll need to confirm this in order to successfully NETFILE your return in H&R Block’s tax software: To do this:

- On the File tab, click the NETFILE Now button.

- Confirm that you didn’t have any income in 2024 or that it was tax exempt by selecting the checkbox in the dialog window that appears:

- Click the I Agree with the Terms and Conditions button to submit your return to the CRA.

- Do you have to file a return? (CRA website)

- I have Indian Status (H&R Block Online help centre)