What do I need to know about NETFILE?

NETFILE is the Canada Revenue Agency’s (CRA) electronic tax-filing service. It allows you to submit your return securely and easily over the Internet using a NETFILE-certified software product (like H&R Block’s tax software).

Choosing to NETFILE your return is a good idea for several reasons, including:

- Highly secure and confidential – During the NETFILE process, the CRA takes significant precautions to ensure your data remains secure.

- No more uploading – No more uploading a “.tax” file to the CRA!

- Quicker refunds – When you NETFILE, your return is processed much faster than a paper return (in many cases, you can get your refund in as few as 8 business days)

- Greater accuracy – Since a CRA representative won’t need to re-enter your information, there’s less chance of an error being made in your return

- Keep your slips at home – When you NETFILE your return, you won’t need to mail in any of your slips or supporting documents unless the CRA specifically asks to see them

- Immediate confirmation – Once you NETFILE your return, the CRA will send you a confirmation that it’s be received, usually within a few seconds

Yes! Canadian residents filing a Québec return can also take advantage of the NetFile Québec service. Like NETFILE, NetFile Québec provides a safe and secure platform through which taxpayers can submit their return to the government. As you might expect, the advantages of using NetFile Québec mirror those offered by the CRA service, offering users a much quicker processing time, immediate confirmation of receipt, and a higher degree of accuracy.

If, on the File tab, you clicked on the NETFILE NOW button and agreed to the terms and conditions, you transmitted your return to the Canada Revenue Agency (CRA) through NETFILE. In addition, once you NETFILE successfully, you will receive a confirmation number from the CRA that they have received your tax return within a few seconds of transmitting your return. You will also see the confirmation number in the tax software once you NETFILE and click Continue on the File tab.

Once you NETFILE your return, the CRA will issue a confirmation number after it does a preliminary check of your return and the return is accepted. You will also see the confirmation number in the tax software once you NETFILE and click Continue on the File tab.

We recommend that you keep the confirmation number for your records.

After you have received the confirmation number, the CRA may contact you for clarification or to verify some information. Otherwise, the CRA will issue your notice of assessment (NOA) once your return is processed. If you are registered for My Account, you can find out the status of your return there.

Note: If this is your first year filing a tax return, you won’t be able to use the services typically available through the CRA My Account service; this is because the CRA requires that you file one tax return before you can register.

To make any changes after you transmit your return by NETFILE, you have to wait for your Notice of Assessment (NOA) from the CRA. Once you receive your NOA, you can use the ReFile feature in H&R Block’s 2025 tax software to adjust and re-file a return you filed via NETFILE.

You can also change a filed return through CRA’s My Account (if you are registered). Under Tax returns, click the Go to Tax returns link. Then, under Related services, click Change my return. You can change the current year return and returns for the previous 9 years this way.

If you don’t have access to My Account or don’t want to use the ReFile feature, you'll need to complete and file form T1 Adjustment Request or submit a signed letter with details of the changes you are requesting (including year of return to be changed, social insurance number, address, and phone number). You must mail all supporting documents for the change to your tax centre, including those for the original assessment, unless already sent.

Note: Online changes to your return usually take two weeks and mailed change requests can take up to eight weeks.

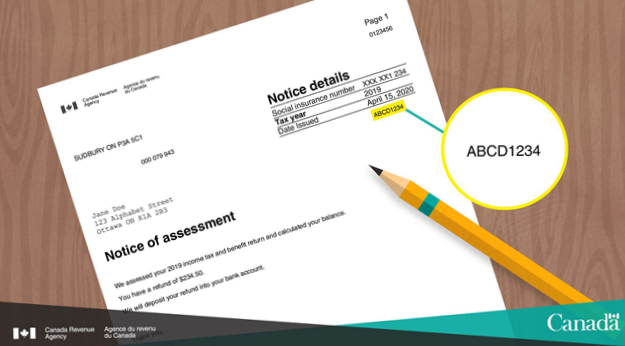

Your unique NAC code is located on the right side of your Notice of Assessment (NOA) for the previous tax year. On the paper version of your NOA, the NAC can be found on the right side under Date issued.

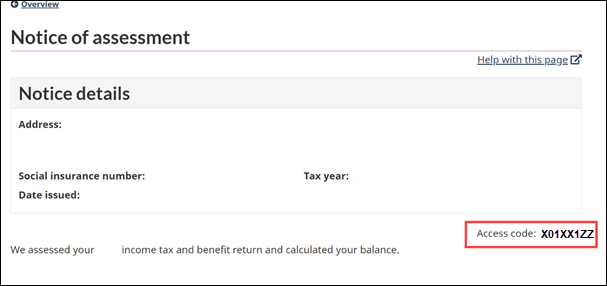

If you’re viewing your NOA in CRA My Account, your NAC is labelled Access code and can be found under the Notice details box.

Yes, you have to NETFILE your T1 General Tax Return to Canada Revenue Agency (CRA) and your TP1 Québec Tax Return to Revenu Québec (MRQ) separately. Once you NETFILE your returns to the CRA and MRQ, you will receive confirmation numbers from both. We recommend that you keep these confirmation numbers for your records.

No, you must NETFILE you own tax return to the CRA. Another person cannot NETFILE on your behalf.

Once you have received your confirmation number from the CRA, they have your return. The CRA starts processing your return immediately and if they do not require any further information from you, your return may be processed within 8 business days.

If you filed your return through NETFILE and have direct deposit set up with the CRA, you should receive your refund in as little as eight business days. It may take longer for you to have your return processed and receive a refund, if your return is selected for a more detailed review.

If you are signed up for direct deposit and have provided your bank account information to the CRA for one or more payments (such as GST/HST credit or the Canada child benefit), the CRA will use that information to directly deposit your refund. If you are entitled to a new payment you will have to contact the CRA to authorize them to use the existing information they have on file. If your banking information changes at any time during the year, make sure you notify the CRA of these changes.

You cannot use NETFILE to request direct deposit. To register for direct deposit, complete the Canada direct deposit enrolment form and mail it to the address on the form. You can also sign up for direct deposit using the CRA’s My Account service (registration required).

Note: H&R Block’s tax software does not currently support the Canada direct deposit enrolment form.