How do I amend or edit my return using ReFILE?

You can make changes to a return you’ve already filed with the ReFILE feature. ReFILE lets you amend and resubmit a return to government through the tax software you used to prepare and file your return. ReFILE is quick, efficient (no postage or paper required), and simple, and it's available in H&R Block’s 2025 tax software.

Note:

ReFILE is available for your return only when you’ve received your notice of assessment from the Canada Revenue Agency (CRA), and only if your original return was filed electronically.

Only use ReFILE if the updates you made in the tax software changes your balance owing or refund amount.

Some of the most common scenarios where you might want to ReFILE your return are:

- You got a late slip (e.g. RRSP contribution slip) that you did not include in your original return

- You forgot to include a source of income in your original return

- You forgot to claim a deduction or credit that you are entitled to

Note: You can't use ReFILE to make any adjustments to your personal information (changed marital status, changed address, etc.) or if a ReFile restriction applies to you; it can only be used to adjust a filed tax return (e.g. missed reporting income, forgot to include a slip, etc.).

You can’t use ReFILE to amend or adjust your return if:

- Your original return was filed by mail

- Your original return hasn’t been assessed yet

- You have a reassessment that’s in progress

- You’re applying for child and family benefits

- You’re applying for the disability tax credit

- You changed an amount carried back to a previous year, such as a capital or non-capital loss

- You immigrated to Canada in 2025

- You're splitting pension income or changed an amount related to pension income splitting

- You’re allocating a refund to other CRA accounts

- You’re subject to income tax for more than one province or territory

- Your original return was filed by the CRA as a 152(7) assessment

- You’re amending an election or making an election (such as one on the T2057: Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation form)

Note: Your 2025 return has been assessed if you’ve received a notice of assessment (NOA) for it (through My Account, or mail)

You can use the ReFILE service to amend your 2025, 2024, 2023, 2022, 2021, 2020, and 2019 tax returns. However, you’ll need to use the H&R Block's tax software for the specific year the return belongs to. For example, to ReFILE your 2024 tax return, you can only use the 2024 H&R Block tax software.

Click here if you want to amend your 2023 tax return.

Click here if you want to amend your 2022 tax return.

Click here if you want to amend your 2021 tax return.

Yes! If you need to amend your Québec return (TP-1), you can use the ReFILE functionality within H&R Block’s 2025 tax software to adjust and submit your return electronically. Keep in mind, in order to ReFILE your return, you must have submitted your original CRA and Revenu Québec returns through NETIFLE. You also have to wait until you’ve received your notice of assessment before you can ReFILE your return.

You can also choose to print out the adjusted return and mail it to Revenu Québec.

Follow these steps in H&R Block's 2025 tax software:

- On your Dashboard, OPEN the return that you want to adjust.

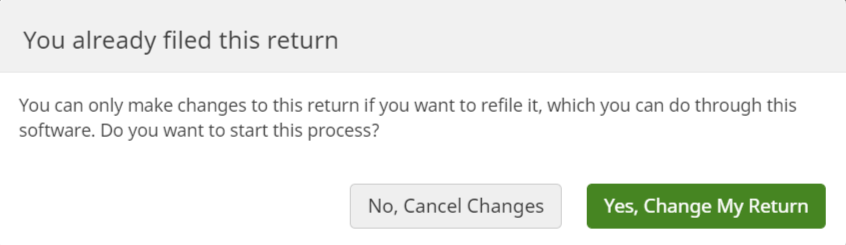

- When you make a change to a slip, form, or field in your return, you will see a pop-up asking if you want make changes to a return that has already been filed. To confirm that you want to make changes to your return, click Yes, Change My Return.

Note: You can’t make changes to your personal information with ReFILE.

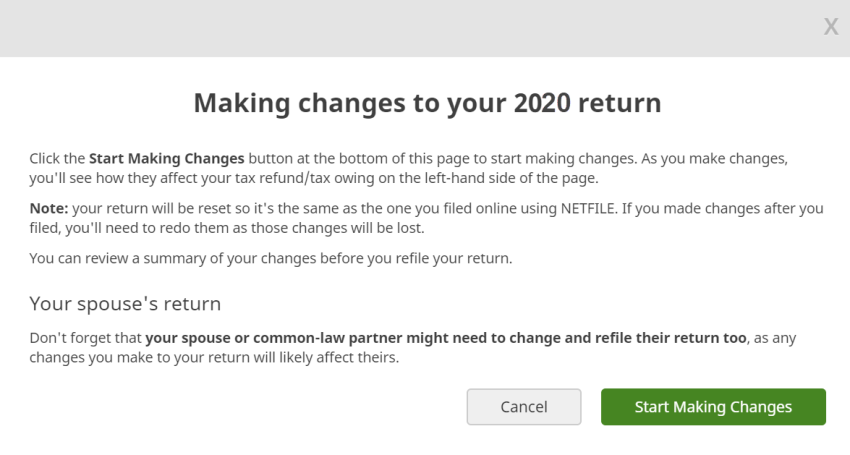

- In the Making changes to your 2025 return window, click Start Making Changes.

- Make changes to your return as required.

- When you arrive at the SUMMARY page under Wrap-Up, click ReFILE Summary to see how your changes have impacted your return.

- When you’re ready, click ReFILE Now on the File tab to submit your amended return.

Note: If you’re adjusting a Québec return, before you ReFILE, you might have to answer some questions from Revenu Québec about why you amended your return.

Yes. If you’ve filed your 2025 T1135 and need to make changes to it, you can file an amended T1135 form.

Once you’ve made changes to your T1135 form in H&R Block’s tax software:

-

Navigate to the File tab.

-

Select the method with which you want to refile.

Note: When you file your amended T1135 form, the method with which you refile must match your original filing method. For example, if you originally filed your T1135 form online with NETFILE, your amended T1135 must also be filed online.

-

If your refile method is Online, click Amend Now next to your amended T1135 form. If your refile method is By Mail, click Mail-in Version next to your amended T1135 form to download the form. You’ll need to mail this form to the CRA.

If you ReFILE’d your 2025 return, but then see a mistake in the ReFILE’d copy that you need to fix, you will need to complete a second ReFILE after you amend your return. To do this:

- Log into H&R Block’s 2025 tax software.

- On the Dashboard, click Edit for ReFile next to the return you want to amend.

- Follow steps 2 to 6 in the section How do I ReFILE my 2025 tax return in the software?.

If you made changes and ReFILE’d a previous year’s return by mistake, you can fix this by making a second ReFILE. You can change your return entries to the original information, then submit it again. Here’s how:

- Log into H&R Block’s 2025 tax software.

- On the Dashboard, click Edit for ReFILE next to the return you submit in error.

- Follow steps 1 to 3 instructions in the section How do I ReFILE my 2025 tax return in the software?.

- In step 4, re-enter any information you changed accidentally, so that it’s the same as your original return.

- Follow steps 5 and 6 to complete your ReFILE.

Note: You can ReFILE one return up to nine times, however this can impact processing times.

- ReFILE: Online adjustments for income tax and benefit returns (CRA website)

- Request for an adjustment to an income tax return (Revenu Québec website)