How can I transfer my unused federal tuition amounts to my spouse, common-law partner, or relative?

Before you can transfer any of your federal tuition amounts to an eligible family member, you must first figure out how much of a credit is available to you, as well as the amount you’ll need to reduce your own federal tax payable. H&R Block’s tax software calculates these amounts for you once you’ve entered the information from your from your tax certificate (such as a T2202, TL11A, or TL11C) into the software.

Once you’ve used your tuition amounts to reduce your own federal (and provincial) tax payable, you can choose to transfer any remaining amounts to one of following people:

- Your spouse or common-law partner

- Your parent or grandparent or

- Your spouse’s or common-law partner’s parent or grandparent

Note: You can’t transfer tuition (and education and textbook) credits that have been carried forward from a previous year; only current year tuition amounts can be transferred.

When transferring these amounts to an eligible family member, be sure to complete the transfer section of your tax certificate and provide a copy to the person receiving the transfer amount.

Things to keep in mind:

- If your spouse is claiming the spousal (or common-law partner) amount on your behalf, your spouse is the only person you can transfer your unused tuition amounts to.

- If you’re transferring both your unused federal and provincial tuition amounts, they must be transferred to the same person.

- The maximum credit amount that can be transferred is $5,000 less any amount you used on your own return.

Follow these steps in H&R Block’s 2025 tax software:

If you indicated that you're single, divorced, separated, widowed, or preparing your return separate from your spouse:

- On the left navigation menu, under Wrap-Up, click Final Review.

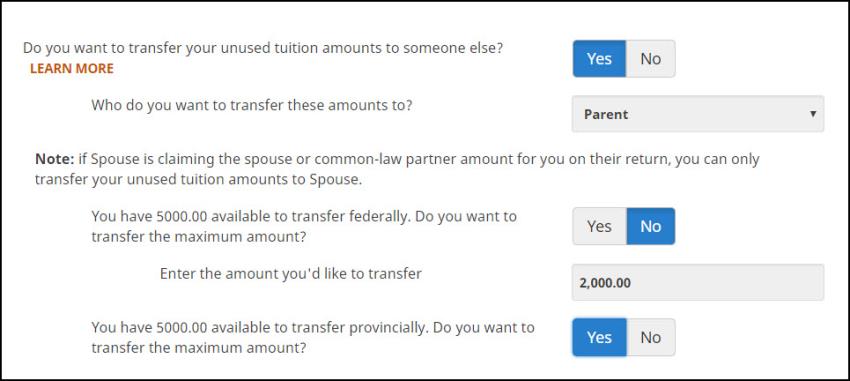

- On the Claimed Credits page, select Yes in response to the question Do you want to transfer your unused tuition amounts to someone else?.

- Select the person to whom you want to transfer the amount to and if you aren’t transferring the full credit amount, enter the amount you want to transfer.

If you are preparing your return with your spouse (coupled return):

- On the left navigation menu, under Wrap-Up, click Final Review.

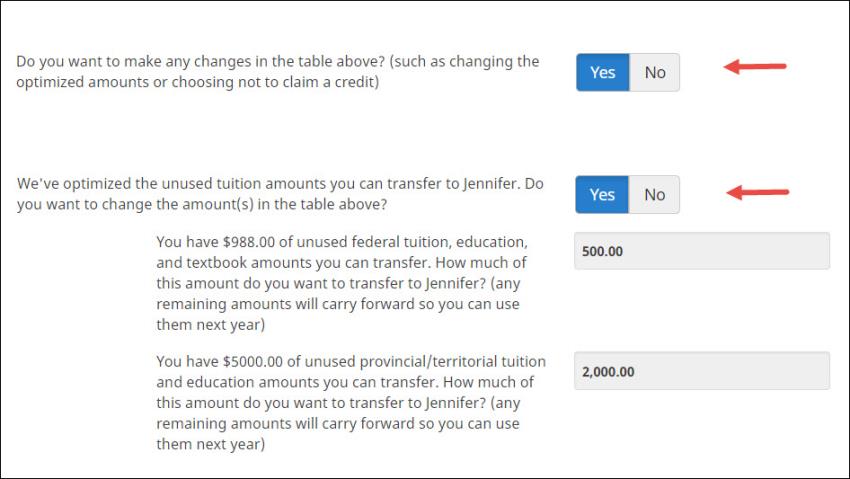

- On the Optimized Credits page, select Yes in response to the question Do you want to make any changes in the table above? (such as changing the optimized amounts or choosing not to claim a credit).

- Select Yes in response to the question, We've optimized the unused tuition amounts you can transfer to Spouse. Do you want to change the amount(s) in the table above or transfer your unused amounts to someone else?.

- From the drop-down menu next to the question Who do you want to transfer your unused tuition amounts to?, select the person you wish to transfer these amounts to.

- Enter the amount you wish to transfer.