Does this dependant live with you?

In H&R Block’s 2024 tax software, your answer to this question determines if you’re eligible to claim certain dependant-related deductions and credits on your return, including:

- Eligible dependant amount

- Canada caregiver tax credit

- Disability transfer

- Tuition transfer

Other information, like the age of your dependant, will be used to calculate amounts like the GST/HST credit or the Canada Workers Benefit credit (CWB) (previously the Working Income Tax Benefit).

Note: In general, even if a dependant lived with you for only part of the year, answer Yes to the question, Does this dependant live with you?.

By doing so, the tax software will be able to determine your eligibility for any of the above mentioned tax credits. This includes a situation where the dependant was not living with you at the end of the year. In more complex situations (for example; dependants moving in and out of various homes or shared custody agreements), speak to one of our Tax Experts for more guidance.

A dependant is typically someone who:

- Is a child under 18, grandchild, parent, grandparent, brother, sister, niece, nephew, aunt, or uncle (of yourself or your spouse or common-law partner), or someone who is mentally or physically infirm

- Is related to you by blood, marriage, or adoption

- Lived with you in Canada in a home that you maintained

Remember, if you share custody of your dependant with someone else, only one parent can claim the deductions mentioned above.

Follow these steps in H&R Block’s 2024 tax software:

-

On the left navigation menu, under Get Started, click .

-

Answer Yes to the question, Do you have dependants? (a child or relative you supported financially), then click Continue.

-

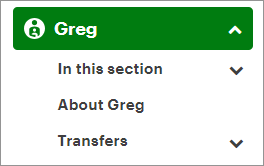

On the left-navigation menu, click the name of your dependant.

-

Enter your dependant’s information into the spaces provided on the page. Before you click Continue, make sure you answered Yes to the question, Does your dependant live with you?.

Once you’ve entered your dependant’s information into the tax software, follow these steps to claim your dependant-related credits*:

- Click the name of the dependant located on the left-hand navigation panel.

- Under the EXPENSES and Transfer amounts headings, select all the expenses and transfer amounts that applied to you in 2024. When you’re finished, click Continue.

- When you arrive at the page(s) of the expense(s) and transfer amounts you selected, enter your information into the tax software.

*Certain credits, like the eligible dependant amount, can be optimized in the Dependant amounts page of the Final Review section.

Important: If you indicated that your marital status was married or in a common-law relationship, you might need to tell us which of you will be claiming which credit under the Final Review section on the Wrap-Up tab.