T4E: Statement of employment insurance and other benefits

Your T4E: Statement of employment insurance and other benefits slip shows you the employment insurance and other benefits you received or repaid in the year, and any income tax that was taken off from these amounts. You’ll get a T4E if you received:

- COVID-19 related benefits (like the Canada Emergency Response Benefit (CERB))

- Amounts paid to you because you lost your job through no fault of your own

- Work-sharing benefits

- Financial assistance because you were part of an approved employment program

- Maternity and/or parental benefits

- Tuition assistance

Note: If you didn’t receive a T4E slip and you think you should have, you can check your My Service Canada account (if you’re registered), and view and print any copies you find in there. You can also contact Service Canada at 1-800-206-7218 to have duplicate slips sent to you.

If you applied for the Canada Emergency Response Benefit (CERB) through Service Canada, your payments will be included with your regular Employment Insurance (EI) benefits in box 14 on your T4E slip. You’ll get a statement listing the benefits you received during the year, so you’ll know exactly how much CERB you were given. If you applied for the CERB through the Canada Revenue Agency (CRA), you’ll receive a T4A slip showing the amount of CERB you received instead.

If you received federal COVID-19 benefits through Service Canada in 2020 and repaid some in 2021, you’ll receive a T4E slip showing how much you repaid.

You’ll find the total amount of federal COVID-19 benefits you repaid this year in box 30. You can claim all or some of this amount on your 2021 return.

Keep in mind, the amount in box 30 might also include Employment Insurance (EI) benefits you repaid in 2021. You can find a list what amounts are included in this box through your My Service Canada Account. If you still don’t have your T4E slip, contact Service Canada.

Note: If you received federal and/or provincial COVID-19 benefits through the CRA, you’ll receive a T4A slip showing the amount you repaid instead.

If you’re a Québec resident and received benefits under the Employment Insurance Program, you may get a T4E(Q) slip. You should enter your T4E(Q) slip as if it is a T4E slip (the calculations will be the same).

For parental benefits under the Québec Parental Insurance Plan, you’ll get an Relevé 6: Régime québécois d'assurance parentale slip. You’ll need to enter the information from both your T4E (or T4E(Q)) slip and your RL-6 slip into the tax software.

Follow these steps in H&R Block’s 2025 tax software:

-

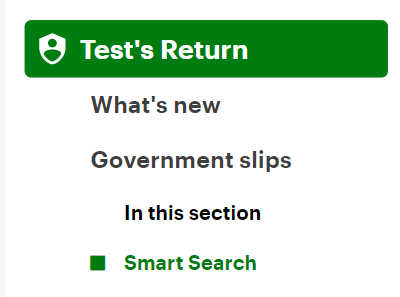

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type T4E in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the appropriate page for your T4E slip, enter your information into the tax software.

Note:

If you have a T4E(Q) slip, you should enter it exactly as the steps describe for a T4E slip.

If you also have an RL-6 slip to enter, repeat Step 1 above, type in RL-6 in the search field and either click the highlighted selection or press Enter to continue. When you arrive at the page for your Relevé 6: Régime québécois d'assurance parentale, enter your information into the tax software.