T4A: Pension, retirement, annuity and other income

You’ll receive a T4A: Statement of Pension, Retirement, Annuity, and Other Income slip for payments from any of the following income sources:

- Pension, superannuation, or annuities

- Lump-sum payments

- COVID-19 support payments

- Repayments of COVID-19 support payments

- Self-employed commissions

- Registered education savings plan (RESP) educational assistance payments or accumulated income payments (AIPs)

- Other income such as research grants, scholarships, medical travel assistance, and Registered Disability Savings Plan (RDSP) income

- You can find a complete list of other income sources on the Canada Revenue Agency (CRA) website.

Generally, you’ll only receive a T4A slip from the payer of these income sources if the total of the payments was more than $500 in the year or if income tax was deducted from the payments.

Tax tip: If you received more than one T4A slip, be sure to report each one separately on your tax return.

If you were issued a T4A slip for member refunds or rebate amounts that you received from a cooperative such as the Federated Co-op Ltd. (FCL) or the Calgary Co-op, you’ll still need to enter these amounts on the T4A page in H&R Block’s tax software. Don’t worry, these amounts aren’t taxable if they were member refunds for personal-use consumer goods (like groceries, household items, gas, etc.).

Be sure to answer Yes to the following question on the T4A page, otherwise the amounts will be included in your income: Were the patronage allocations you entered in box 30 related to goods or services you consumed (personal purchases)?

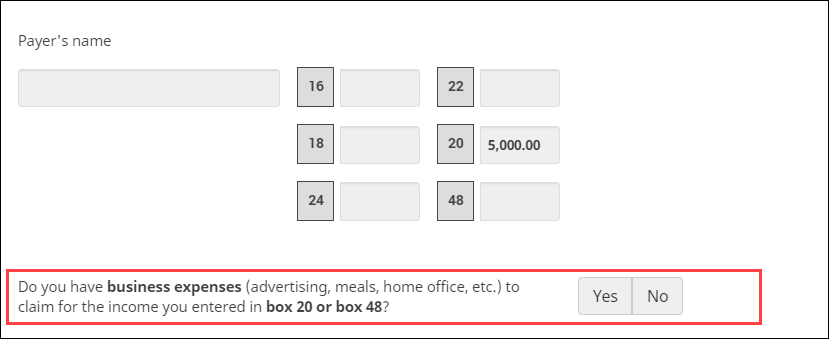

Amounts in box 20 (self-employment commissions) and box 48 (fees for services) of a T4A slip are treated as self-employment income. These amounts should not include any GST/HST paid to you on commissions or fees for services.

Note:You’ll need to enter the mailing address you had in 2025 when you received this self-employment income. The province or territory of this mailing address must match the one you lived in on December 31, 2025 (as indicated on the Get Started tab) to use the software. However, if it is different, simply contact the retail office closest to you, and one of our Tax Experts will be happy to help (fees will apply) software.

Depending on whether you have business expenses or not for this income, you might have to complete the T2125: Statement of business or professional activities page in addition to the T4A page in the tax software.

If you have business expenses (like meals, advertising, etc.) for the income you entered in boxes 20 or 48:

Answer Yes to the question Do you have business expenses (advertising, meals, home, office, etc.) to claim for the income you entered in box 20 or box 48?. You’ll need to complete the T2125 page in addition to the T4A page in the tax software. Refer to the I have business expenses to claim for my self-employment income section below for more information on how to do this.

If you don’t have business expenses to claim for this income:

Answer No to the question Do you have business expenses (advertising, meals, home, office, etc.) to claim for the income you entered in box 20 or box 48?. You won’t need to complete the T2125 page, but you’ll need to give more information about your self-employment activities. Refer to the I don’t have any business expenses for my self-employment income section below for information on how to complete these additional fields.

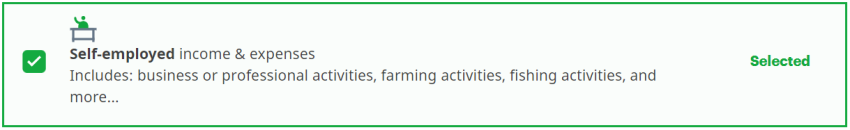

If you have an amount in box 20 and/or box 48 on your T4A slip and you have business expenses to claim for this income, you’ll need to also complete the T2125: Statement of business or professional activities page in H&R Block’s tax software and report your business income and expenses.

Once you’ve finished entering your T4A slip amounts on the T4A page in the software, follow these steps to add a T2125 page to your return:

-

On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

-

Select the Self-employment income & expenses checkbox.

-

At the bottom of the page, click Add selected topics to my return.

-

Click the Employment tab on the left navigation menu.

- Under the BUSINESS AND SELF-EMPLOYMENT INCOME heading, select the checkbox labelled Statement of business or professional services then click Continue.

- When you arrive at the Statement of business or professional services page, enter your information into the tax software.

If you don’t have any business expenses to claim for your self-employed income, on the T4A page, enter details about your self-employment activities in the fields that appear as you enter more information.

While these questions are from the T2125 form, the tax software has made it easy for you to complete only the necessary fields since you’re not claiming business expenses and capital cost allowance (CCA).

- Business name

- Your account number assigned by the CRA

- Main product or service

- Type of income earned. From the drop-down list, choose either::

- Business income – income from any activity you do for a profit. This includes commissions or fees from sales and the value of your inventory at the start and end of your fiscal period.

- Professional income – income from a profession that has a governing body (such as one for lawyers, professional engineers, etc.). It includes sales or fees, but usually includes the value of your work-in-progress (WIP). WIP is goods or services that you haven’t yet finished providing at the end of your fiscal period.

- How much taxable gains did you receive from eligible capital property?

If you sold eligible capital property that your business owned, and you realized a profit (capital gain), enter the profit amount here. The CRA says that if you own a business that has a fiscal year end other than December 31, you still have to report the sale of a capital property in the calendar year the sale took place.

If you didn’t have any taxable gains, enter “0”.

- What accounting method do you want to use to report your commission income?

The cash method means you report income in the fiscal period you receive it whether it is in cash, property, or services. You deduct allowable expenses in the fiscal period you pay them, except prepaid expenses. If you are a farmer, fisher, or self-employed commissioned sales agent, you can use the cash method.

The accrual method means you report income in the fiscal period you earn it and deduct allowable expenses in the fiscal period you incur them, whether or not you pay for them in that period.

- From the drop-down list, type a keyword (sales, bookkeeping, legal, etc.) to find the industry code that best describes your main business activity

If more than one code applies to your business, enter the one that most closely describes your main business activity. You can type keywords (sales, bookkeeping, etc.) to find the industry code that most closely describes your main business activity or click here for a complete list of industry codes.

If you received or had to repay taxable COVID-19 support payments from the government, like the Canada Emergency Response Benefit (CERB), you’ll receive a T4A slip for these amounts. You’ll need to enter these amounts into H&R Block’s 2025 tax software.

Note: If you applied for the CERB through Service Canada, you’ll receive a T4E slip showing the amount of CERB you received instead.

Here’s where you’ll find taxable COVID-19 support payments on your T4A slip:

- Canada Emergency Response Benefit (CERB) - Box 197

- Canada Emergency Student Benefit (CESB) - Box 198

- Provincial/Territorial COVID-19 financial assistance payments - Box 200

- Canada Recovery Benefit (CRB) - Box 202

- Canada Recovery Sickness Benefit (CRSB) - Box 203

- Canada Recovery Caregiving Benefit (CRCB) - Box 204

If you received COVID-19 benefits in 2020 and repaid some in 2021, you’ll receive a T4A slip showing how much you repaid.

You’ll find the total amount of federal and provincial COVID-19 benefits you repaid this year in box 201. You can claim all or some of this amount on your 2021 return.

Note: If you applied for federal COVID-19 benefits through Service Canada, you’ll receive a T4E slip showing the amount you repaid instead.

Amounts in box 30 of your T4A slip are patronage allocations from a cooperative corporation, partnership, sole-proprietorship, or an ordinary corporation. These amounts were given to you as a customer for your patronage and can include payments made to you in cash or in kind, by a certificate of indebtedness, by issuing shares, a set-off, or in any other way.

Generally, these allocations are made to you in the same proportion as your patronage and are considered taxable income unless, these amounts were related to consumer goods or services that you purchased for your personal use.

If you enter an amount in box 40 of the T4A page, you'll be asked if you want the software to calculate the additional tax you have to pay on the accumulated income payments (AIPs) you received from an RESP. If you select:

- Yes: The software assumes you're the subscriber of the RESP and calculates the additional tax you have to pay.

- No: You'll need to complete form T1172. You can find this in the left navigation menu, under Other on the Credits & deductions tab.

If you received research grants in 2025(box 104), you’ll need to enter the total amount of expenses you paid in the year to carry out your research projects. Keep in mind, the expenses you report can’t be more than the research grant you received. You can claim the following allowable research expenses:

- salary paid to an assistant

- the cost of minor equipment and supplies

- lab charges and

- travelling expenses (including meals and lodging) you paid while travelling:

- between your home and the place where you temporarily lived while doing the research work

- from one temporary work location to another or

- on field trips connected with your research work

If you received an amount for Scholarships, bursaries, fellowships, artists' project grants, and prizes or received another type of financial assistance this year, you’ll see an amount in box 105 of your T4A slip. For more information on the type of award you received, check out the Students and income tax guide.

Generally, any scholarship, bursary, fellowship, or prize amount you received that’s more than the scholarship exemption amount is considered income. In most cases, the first $500 is tax exempt. If, however, you were considered a full-time qualifying student in 2025, the full amount of your scholarship might be exempted. If you received a scholarship, fellowship, or a bursary related to a part-time program, the exemption that you’re entitled to is equal to the tuition paid plus the amount you paid for program-related materials (up to a maximum of $500).

Notes:

- Enter the amount from box 105 of your T4A slip as is in box 105 on the T4A page in H&R Block’s tax software – the software will automatically calculate if any portion of this amount is taxable.

- If you received an artist grant (an scholarship, bursary, grant, etc. used in the production of a literary, dramatic, musical or artistic work), you’ll be able to claim the amount you paid in related expenses. You can’t claim expenses that were your personal or living expenses, have been claimed elsewhere on your return, or could be reimbursed to you.

Regardless of your age, if you received a T4A slip due to the death of your spouse or common-law partner, you’ll need to enter these amounts on your return even if it’s transferred to an RRSP. For more information, check out line 115 of the General Income Tax and Benefit Guide.

The amount that’s reported in box 196 of your paper T4A slip refers to the amount of adult basic education tuition assistance you received during the year that’s more than the scholarship exemption amount you’re entitled to claim for this type of financial assistance.

This taxable tuition assistance is provided to eligible individuals that are enrolled in a course at a post-secondary institution to develop or improve skills in an occupation that’s certified by Employment and Social Development Canada.

Note: Even though you can’t claim a tuition tax credit for the fees you paid (because you received adult basic education tuition assistance) you can still claim a deduction for the tuition assistance you received.

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type T4A in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the appropriate page for your T4A slip, enter your information into the tax software.