Carry forward my return: Transfer your 2023 information into your 2024 return

If you used H&R Block’s tax software last year to prepare your return, you can carry forward your return to transfer your personal information and carry forward amounts (such as your HBP/LLP amounts, unused tuition amounts, certain provincial tax credit amounts, and more) from your 2023 return directly into your 2024 return – saving you time!

If you don’t want to transfer your 2023 information into your 2024 return, don’t worry – you can use the information on your latest notice of assessment (NOA) or notice of reassessment to complete your 2024 return.

Before you begin, you’ll need to log into H&R Block’s 2024 tax software using the same account (username/email ID) that you used last year. If you’ve forgotten the username or password, refer to our help centre article on how to retrieve or reset these.

Once you log into H&R Block’s 2024 tax software, follow these steps:

-

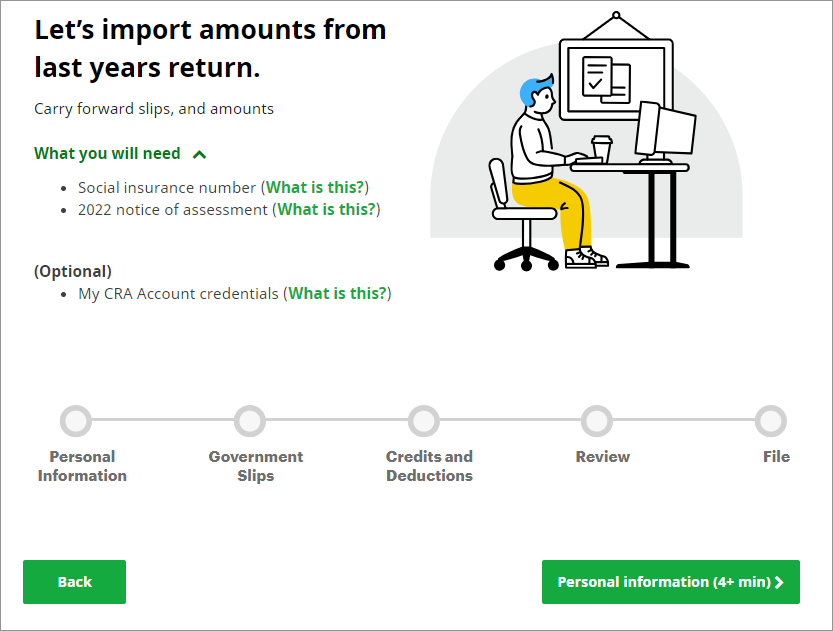

On the Let’s import amounts from last years return page, click Personal information (4+ min).

-

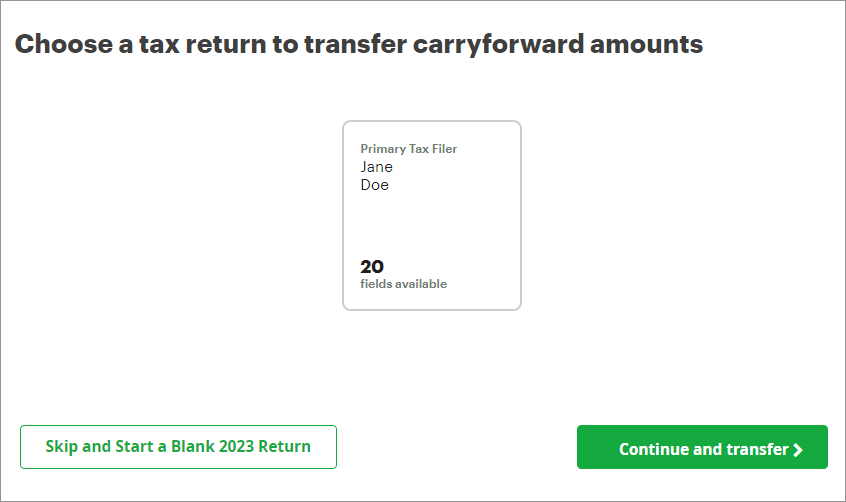

Select the return(s) you want to transfer and click Continue and transfer.

-

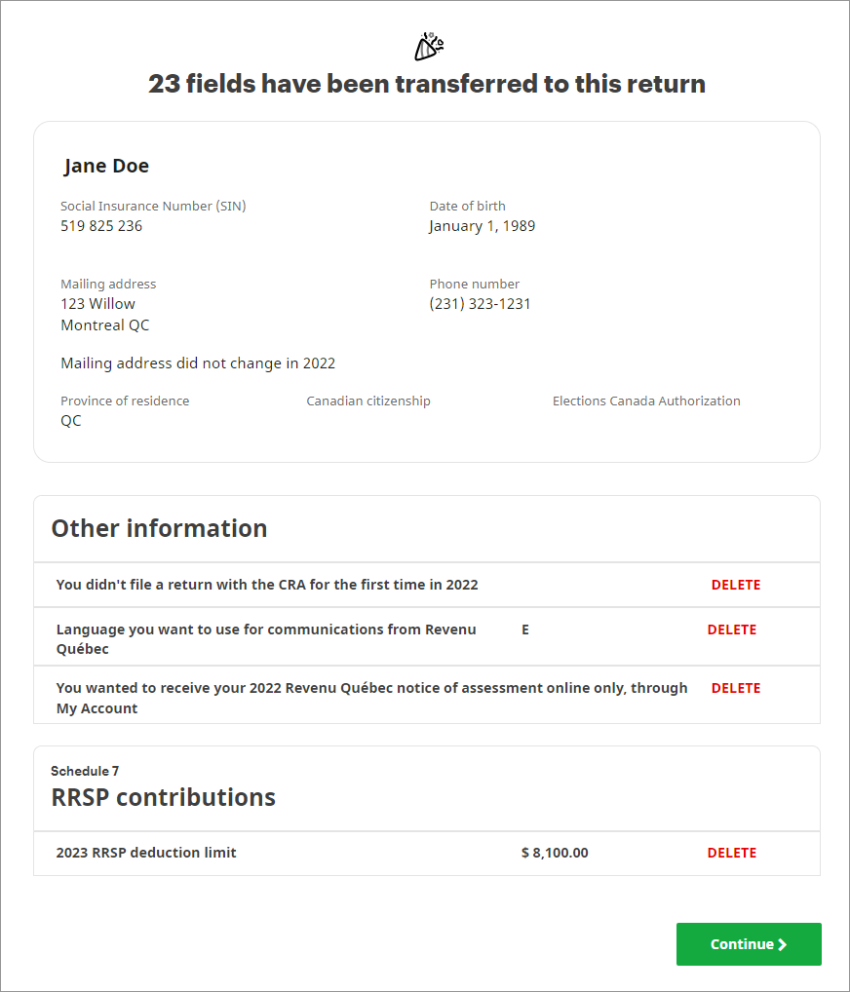

You’ll be able to see all the information that was transferred from your 2023 tax return.

Note: If you want to change any of the information that was transferred from your 2023 return, you’ll be able to do so as you complete your 2024.

-

Click the Continue button at the bottom of the screen to start your 2024 return.

If you created an account last year but didn’t file your return through the H&R Block's tax software, you'll need to create a new return and enter your information manually.

Absolutely! If you used H&R Block's tax software last year and you want to transfer your information directly into this year’s return, all you need to do is follow the steps outlined in the section above.