Your unused provincial tuition amounts

As a student, not only can you claim the federal tuition tax credit to reduce your taxes, but you can also claim a corresponding provincial tuition tax credit to reduce your provincial tax payable to zero. You’ll need to use your tax certificate (such as a T2202, or an RL-8 slip (if you’re a Québec resident)) to complete your provincial Schedule 11 (or Schedule T, if you’re a Québec resident) to determine how much of your credit amount you can claim.

Note: H&R Block's tax software automatically completes your provincial Schedule 11 (and Schedule T, if applicable) based on the information you enter from your tax certificate.

If you don’t need to use all of your provincial tuition credit amount in a given year to reduce your tax payable to zero, you can either:

- Carry forward the unused portion for use in a future year or

- Transfer the unused amount to a family member

Note: Alberta, Ontario, and Saskatchewan have discontinued their provincial tuition tax credits. If you’re a resident of any of these provinces and you’ve got unused provincial tuition amounts, you’ll still be able to claim them or carry forward these amounts for use on future returns. In addition, not all provinces have the education and/or textbook amount tax credits. Refer to the CRA website to see if the education and/or textbook amount tax credits are still available in your province or territory of residence.

If you decide to carry forward your unused provincial tuition amounts, you’ll need to claim them the first year you have to pay tax. You can find your unused provincial credit amounts on your most recent notice of assessment (NOA) or reassessment.

Note: If you move from one province to another (except Québec), your provincial carry forward amount can’t be more than the federal tuition carry forward amount. If you move to another province from Québec, you’ll lose your provincial carry forward amount.

You’ll be able to see how much of your unused provincial tuition amount is available for carry forward (or transfer) on the Claimed Credits page under Final Review of the Wrap-Up tab on the left navigation menu. If you choose not to transfer this amount to a family member, the software will automatically carry forward your entire unused provincial tuition amount.

Tax tip: It’s to your advantage to file a tax return each year, even if you didn’t have any income, so that the Canada Revenue Agency (CRA) or Revenu Québec can update their records with your unused tuition amounts.

You can transfer all or some of your unused credit amount from this year to one person as long as they’re:

- Your spouse or common-law partner or

- Your or your spouse's parent or grandparent

You can only transfer an amount to your or your spouse’s parent or grandparent if your spouse isn’t claiming the following amounts for you:

- Spouse or common-law partner amount

- Amounts transferred from your spouse or common-law partner

The maximum amount you can transfer to a family member is $5,000 minus any amount you need to reduce your own tax payable. Keep in mind that you can only transfer your provincial tuition amounts from this year, since carry forward amounts from a past year can’t be transferred.

You can decide how much of your unused provincial tuition amounts you’d like to transfer on the Claimed Credits page under Final Review of the Wrap-Up tab on the left navigation menu:

This page shows you how much of your tuition credit amounts you’ve got available for transfer to an eligible family member. If you’re filing a single return or are preparing your return separately from your spouse, you’ll be able to transfer your unused tuition amount to a family member on this page. When you answer Yes to the question, Do you want to transfer your unused tuition amounts to someone else?, you can select who you want to transfer the unused tuition amount to and either transfer the maximum amount available or specify the exact amount.

If you’re preparing your return with your spouse (coupled return), H&R Block's tax software will automatically optimize your unused tuition amounts for transfer to your spouse on the Optimized Credits page under Final Review. You’ll be able to change the transfer amount here.

Tax tip: If you decide to transfer an amount to a designated individual, only transfer the amount he or she can use. That way, you can carry forward as much as possible to use in a future year.

To claim the tax credit, enter information from your tax certificate (and Relevé 8, if applicable) into H&R Block's tax software as follows. The software will automatically complete your provincial Schedule 11 (and Schedule T, if you’re a Québec resident).

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type the name of the slip/tax certificate you received (such as the T2202, TL11A, RL-8, etc.) in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your slip/tax certificate, enter your information into the tax software.

To claim your unused tuition tax credit that you carried forward from a previous year, follow these steps in H&R Block's tax software:

-

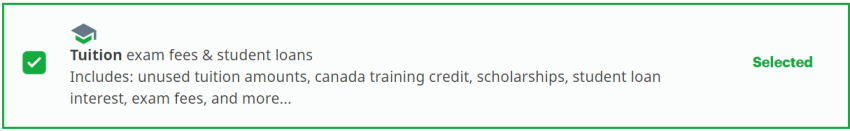

On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

-

Select the Tuition exam fees & student loans checkbox.

-

Click the Students tab on the left navigation menu.

- Under the CREDIT AMOUNTS section, click the checkbox labelled Unused tuition, education, and textbook amounts, and Canada training credit (Schedule 11), then click Continue. If you’re a Québec resident, select Tuition or examination fees carried forward from a previous year (Schedule 11 & Schedule T) and click Continue.

- When you arrive at the selected page, enter your information into the tax software.

If you’re single, a widow, or divorced, or preparing your return separate from your spouse to transfer your unused tuition tax credit amount, follow these steps in H&R Block’s 2025 tax software:

-

On the left navigation menu, under Wrap-Up, click Final Review.

-

Under Final Review, click Claimed Credits.

-

On the Claimed Credits page, select Yes in response to the question Do you want to transfer your unused tuition amounts to someone else?.

- Select the person to whom you want to transfer the amount to and if you aren’t transferring the full credit amount, enter the amount you want to transfer.

If you’re preparing your return with your spouse (coupled return), follow these steps in H&R Block’s 2025 tax software:

- On the left navigation menu, under Wrap-Up, click Final Review.

-

Under Final Review, go to the Optimized Credits.

-

Select Yes in response to the question We've optimized the unused tuition amounts you can transfer to {spouse}. Do you want to change the amount(s) in the table above or transfer your unused amounts to someone else?.

- From the drop-down menu next to the question Who do you want to transfer your unused tuition amounts to?, select the person you wish to transfer these amounts to.