TP-1029.BF: Tax shield

If you were a resident of Québec on December 31, 2025 and your income increased during the year, you might be eligible for the Québec tax shield credit. This credit helps offset an increase in employment income, which can cause a reduction in tax credits related to the work premium (including the adapted work premium) and/or childcare expenses.

The Tax shield credit is calculated based on your family situation and your (and your spouse’s, if applicable) income as on December 31.

To be eligible, you must meet the following conditions:

- If you were single on December 31, 2025:

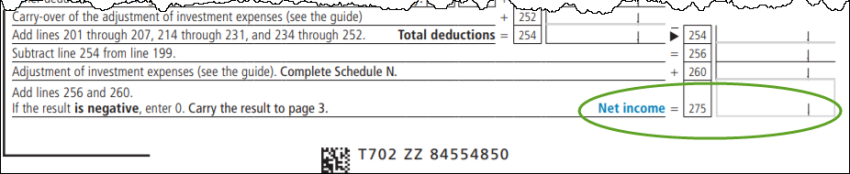

- The net income you’re reporting in 2025 is higher than the amount reported on your 2024 Québec return (refer to line 275* of last year’s Québec return) and

-

The eligible work income you’re reporting in 2025 is

higher than the amount reported on your 2024 Québec return

- If you were married or in a common-law relationship on December 31, 2025:

- The net family income you and your spouse are reporting in 2025 is higher than the amount reported in 2024 (refer to lines 275 of your and your spouse’s 2024 Québec returns) and

- The eligible work income that you and your spouse are reporting in 2025 is higher than the amount reported on your 2024 Québec returns

*You can find line 275 of your Québec return at the bottom of page 2 of your TP-1 form:

Note: When claiming this credit using H&R Block’s tax software, you’ll be given the option to let Revenu Québec claim this credit for you. If you select Yes, you won’t need to enter amounts from your 2024 Québec return; Revenu Québec already has this information on file. If you select No, you’ll need to enter the amount reported on line 275 of your 2024 return(s). If you and your spouse (if applicable) are preparing separate returns, you’ll also need to enter amounts from their 2023 return. It’s important to remember that whatever option you choose, the credit amount you receive will be the same.

Eligible work income can be any of the following:

- Employment income (line 101 of your TP-1 return)

- Correction of employment income (line 105 of your TP-1 return)

- Other employment income (line 107 of your TP-1 return)

- Net income earned from a business you carried on alone or as a partner actively engaged in a business

- The net amounts of research grants (line 154 of your TP-1 return) - you can calculate this amount by subtracting the following expenses (up to the total amount of your grants), from the amount found in box O of your RL-1 slip:

- expenses incurred in 2023 after you received confirmation you’d receive the grant and

- expenses incurred in 2024 and 2025

- Amounts received under a work-incentive project (line 154 of your TP-1 return) - this amount can be found in box O of your RL-1 slip if you received financial assistance in 2024 for the payment of tuition fees that don’t otherwise entitle you to receive the tax credit for tuition or examination fees

When calculating your eligible work income for the tax shield credit, the following amounts are not included:

- Employment income that consists solely of the taxable benefits you received from a previous employer (you’ll find this amount in box 211 of your RL-1 slip. This amount is equal to the total of the amounts found in the following boxes of your RL-1 slip: J, K, L, P, V, and W) or

- Employment income you received as:

- An elected member of a municipal council

- A member of the council or executive committee of metropolitan community or a regional county municipality

- A member of a municipal utilities commission or corporation

- A member of a school board or

- A member of the National Assembly, the House of Commons or the Senate of Canada, or a legislative assembly of another province

You can split your Tax shield credit amount with your spouse or common-law partner. To do this, complete the Tax shield credit (TP-1029.BF-V) page in H&R Block’s tax software. Then, on the Shared credits page under Final Review on the Wrap-Up tab, indicate that you want to split your Québec tax shield credit amount with your spouse. You’ll then be asked to enter the amount your spouse is claiming on their return.

Follow these steps in H&R Block’s 2025 tax software:

Before you begin, make sure that you told us you lived in Québec on December 31, 2025.

- On the left navigation menu, under the Credits & deductions tab, click Other.

-

Under the SPECIFIC CREDITS FOR YOUR PROVINCE heading,

select the checkbox labelled

Tax shield credit (TP-1029.BF-V) then click

Continue.

- When you arrive at the page for the Tax shield credit, enter your information into the tax software.