Solidarity tax credit (Schedule D) & Relevé 31

The Solidarity tax credit helps low-income earners who live in Québec and can be claimed on Schedule D when you file your tax return. The amount of the credit you’re eligible for is determined based on your situation as of December 31, of the tax year.

Example: For the payment period beginning July 2026 to June 2027, your amount will be determined based on your situation as of December 31, 2025.

To be eligible, you must be at least 18 years old, have legal status in Canada, and live in an eligible dwelling. If you’re less than 18 years of age, you might still be eligible to claim the solidarity tax credit as long as you:

- Have a spouse

- Are the parent of a child who lives with you or

- Are recognized as an emancipated minor by a competent authority (like a court)

In addition, your family income must be less than the threshold given by Revenu Québec for this tax credit. Check out Revenu Québec’s website to see if you’re eligible to claim the solidarity tax credit, based on your family income for 2025.

You can’t claim this credit if:

- You were confined to a prison or similar institution for 183 days or more in 2025 or

- Someone received child assistance payments from the Régie des rentes du Québec as payments on your behalf

Keep in mind, if on December 31, 2025, you had a spouse and he or she lived with you, only one of you can claim the solidarity tax credit for both of you. If your spouse did not live with you on December 31, 2025, (for example, one of you permanently lives in a residential and long-term care centre (CHSLD)), each of you can claim the solidarity tax credit.

Note: You must inform Revenu Québec if, you leave Québec permanently, you were confined to a prison or similar institution, or your spouse passes away.

Your solidarity tax credit amount is based on your situation as on December 31, 2025 and the components of the tax credit you’re entitled to. The solidarity tax credit has three components:

When your tax credit is calculated, all three components are taken into account. However, the total tax credit amount might be reduced based on your family income. If your family income for the year is equal to or more than the threshold given by Revenu Québec for this tax credit, you won’t be able to claim it. Refer to Revenu Québec’s website for more information.

Most types of homes are eligible for the solidarity tax credit, but there are exceptions.

As a tenant or subtenant of an eligible home, you’ll receive a Relevé 31: Reporting information about leased dwellings slip from your landlord, which you’ll need to claim the Solidarity tax credit. If you own your own home, you’ll need the roll number or cadastral designation from your municipal tax bill.

The frequency of the Solidarity tax credit payments is based on the amount of credit you’re entitled to receive:

|

Payment frequency |

Annual amount determined |

|

Monthly payments |

$800 or more |

|

Quarterly (July, Oct, Jan, and Apr) payments |

More than $240 but less than $800 |

|

Annually (July) payments |

$240 or less |

Note: In order to receive your payments, you have to be registered for direct deposit, which you can do by following any of these steps:

- Register for the Direct Deposit online service (you’ll also need to register for Revenu Québec’s My Account service).

- Enclose, with your return, a cheque marked VOID on the front along with your name and social insurance number (the cheque must be from a financial institution that operates in Canada).

- Complete a Request for Direct Deposit (LM-3.Q-V or LM-3.M-V). Residents closer to Montréal should complete LM-3.M-V while residents closer to Québec City should complete form LM-3.Q-V.

If you qualify for the Solidarity tax credit, you'll be able to apply for it on the Your income page. To do so:

-

On the left navigation menu, under Wrap-Up, click Final Review.

- Select the Your income page.

- Under the Your claim for the Québec Solidarity Tax Credit heading, enter your information into the tax software.

-

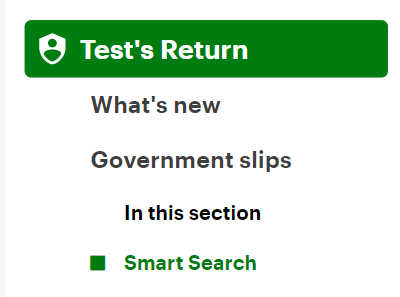

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type RL-31 or relevé 31 in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the RL-31 page, enter your information into the tax software.

- On the left navigation menu, under Wrap-Up, click Final Review.

- Select the Your income page.

- Under the Your claim for the Québec Solidarity Tax Credit heading, enter your information into the tax software.

As a homeowner, if you don’t want to claim the Solidarity tax credit, simply answer No to the question Do you want to claim this tax credit? under the Your claim for the Québec solidarity tax credit section on the Your income page. You can find this page in the Final Review section under the Wrap-Up tab.

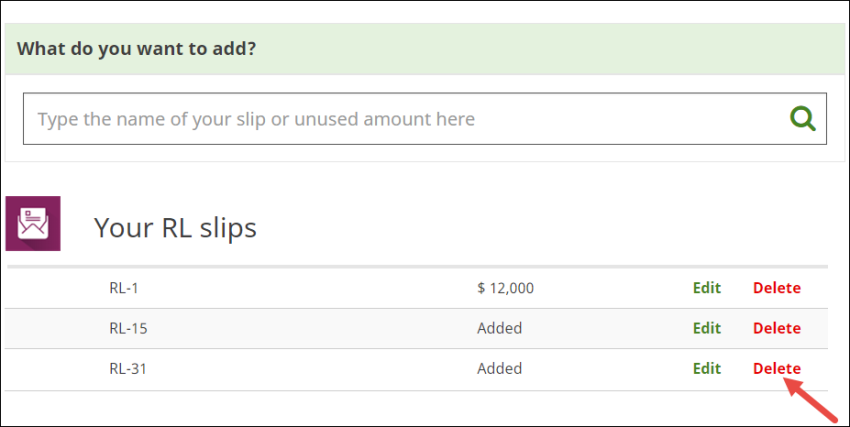

If you rent your home, you’ll need to follow the above instructions indicating you don't want to claim the tax credit and remove the RL-31 slip you entered in your return. Here’s how to do that:

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Under Your RL-slips, click the Delete link next to the RL-31 page.