Schedule H: Québec tax credit for caregivers

Important: There are significant changes to the Québec tax credit for caregivers for tax year 2025 and onwards.

If you were a caregiver in 2025, you can claim the Québec tax credit for caregivers on Schedule H. You can claim this tax credit if you were a resident of Québec on December 31, 2025 and you were a:

- Caregiver for a person 18 years or over with an impairment

- Caregiver for a relative (not your spouse or common-law partner) 70 years or over

Note: You can’t claim this tax credit if you are claiming the tax credit for volunteer respite services or the tax credit for respite of caregivers for the same person.

You can claim this credit if you meet the following basic conditions:

- You weren’t paid for the care you provided

- No one is claiming the tax credit for caregivers for you

- Your spouse is the only one claiming the following amounts for you:

- Amount for dependants and amount transferred by a child 18 or over enrolled in post-secondary studies

- Medical expenses and expenses paid for medical services not available in your area

- You (or your spouse or common-law partner, if applicable) were not tax exempt in 2025

You must also meet these requirements for the specific type of caregiver credit you’re claiming.

-

Caregiver for a person 18 years or over with an impairment

You can claim up to $1,494 if you provided care to:

- A person 18 years of age or over with a severe or prolonged impairment in mental or physical functions

- This person for at least 365 consecutive days, including 183 days in 2025

You can claim an additional $1,494 if you lived with this person in a house that is owned or rented by you, your spouse or common-law partner, person receiving care (care receiver), or care receiver’s spouse.

The care receiver can be:

- your spouse or common-law partner

- your or your spouse’s child, grandchild, nephew, niece, brother, or sister

- your or your spouse’s father, mother, grandfather, grandmother, uncle, aunt, great-uncle or great-aunt

- someone who is not related to you, as long as a health certifies that you provide ongoing assistance to this person so that they can carry out a basic activity of daily living

Note: If the care receiver lives in a private seniors’ residence or in a public network facility, you won’t be able to claim the credit.

You’ll need to submit a TP-752.0.14-V: Certificate Respecting an Impairment form (if you haven’t already filed one) to Revenu Québec confirming that due to a severe and prolonged impairment in physical or mental functions the person you’re supporting needed assistance in carrying out a basic activity of daily living.

If the person is not related to you, you’ll need to also complete form TP-1029.AN.A-V: Certificate of Ongoing Assistance. Part 5 of this form must be completed by a health care professional confirming that you are providing ongoing assistance to this person. This certificate must be renewed every 3 years.

Note: Keep the completed TP-1029.AN.A-V form in your records in case the Revenu Québec asks to see it later.

-

Caregiver for a relative (not your spouse or common-law partner) 70 years or over

You can claim up to $1,494 if:

- You lived with a person (not your spouse) who is 70 years or older and does not have an impairment.

- You lived with this person in a house that is owned or rented by you, your spouse or common-law partner, person receiving care (care receiver), or care receiver’s spouse.

- You lived with this person for at least 365 consecutive days, including 183 days in 2025

You might be able to claim an additional amount (up to $5,200) on Schedule H if you paid for specialized respite services in 2025 for the care and supervision of a person you lived with who has an impairment.

Follow these steps in H&R Block’s 2025 tax software:

Before you begin, make sure you’ve indicated that you lived in Québec on December 31, 2025.

-

On the left navigation menu, under the Credits & deductions tab, click Other.

-

Under the DISABILITY-RELATED CARE heading, select the checkbox labelled Tax credit for caregivers (Schedule H) then click Continue.

-

When you arrive at the Tax credit for caregivers (Schedule H) page, enter your information into the tax software.

If you want to claim this tax credit for a dependant, in addition to selecting Québec as your province of residence on December 31, be sure to provide details for your dependant on the Dependant Information page. This can be found by clicking under Get Started on the left navigation menu. Then:

-

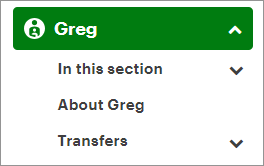

On the left-navigation menu, click the name of your dependant.

-

Under the Tax Credits heading, select Tax credit for caregivers (Schedule H) and click Continue.

-

When you arrive at the Tax credit for caregivers (Schedule H) page, enter your information into the tax software.

Note: While completing this page, you’ll need to have the adjustments of social assistance payments your dependant received during the year on hand. These are additional amounts on top of the social assistance payments your dependant receives for his or her basic care needs.

You will need to split the tax credit if the person you provided care to (care receiver) had other caregivers and if:

- You lived with or provided care to the care receiver for at least 90 days in 2025

- Each caregiver lived with or provided care to the care receiver for least 90 days in 2025

- You and the other caregiver(s) lived with or provided care to the care receiver for at least 365 days, out of which at least 183 days were in 2025

You’ll be able to split the tax credit in H&R Block’s tax software on the Dependant amounts page under Final Review on the Wrap-Up tab.

Note: You’ll need to have the other caregiver’s social insurance number (SIN) on hand when you complete this page.