Transferring the disability amount from a dependant other than your spouse

When transferring the disability amount from a dependant that isn’t your spouse (like a child, parent, or grandparent), you’ll need to enter these amounts from your dependant’s return to calculate the disability amount that can be transferred to you:

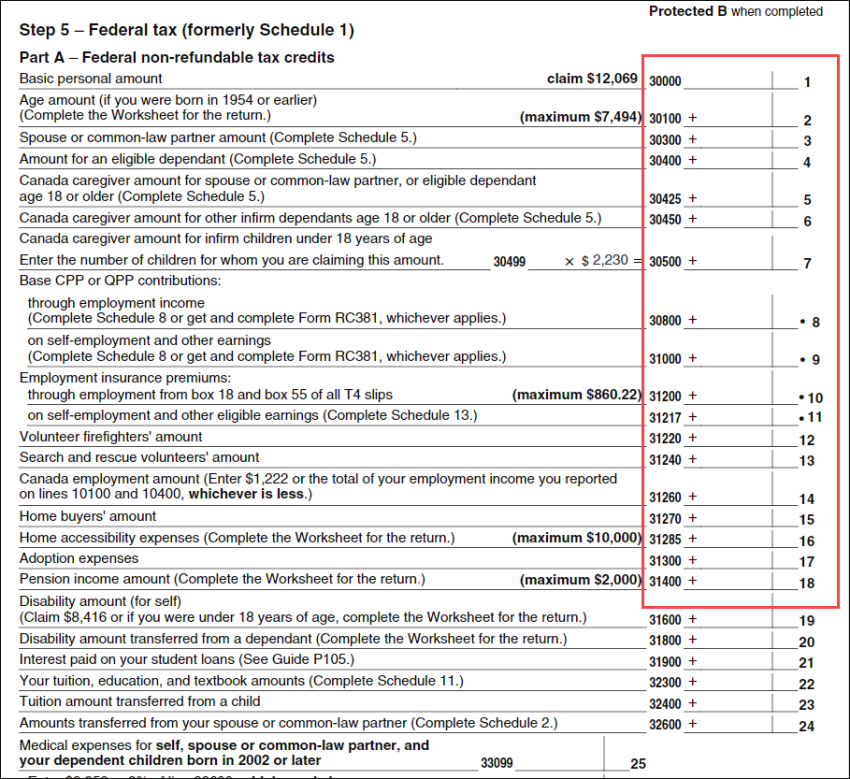

- the total amount from lines 1 to 18 located on your dependant’s Federal tax page (formerly Schedule 1)*

- line 11 under Part A of your dependant’s RC269 (if applicable)

*Lines 1 to 18 represent your dependant’s federal non-refundable tax credits.

You’ll need to complete your dependant’s return first to know the amounts that you’ll need to enter. If you’ve used H&R Block’s tax software to complete your dependant’s return, refer to the appropriate section of their PDF Tax Summary to locate the above amounts.

Note: You can download your dependant’s PDF Tax Summary (Preview of your return(s) in a PDF) from the SUMMARY page under the Wrap-Up tab.