Dependant's physical or artistic activities

Important: The federal children’s fitness tax credit and children’s arts amount was eliminated in 2017.

If you’re a resident of Manitoba, Saskatchewan, Nova Scotia, Prince Edward Island, Québec, or the Yukon, and your child was enrolled in a prescribed physical or fitness activity (like soccer, skating, swimming, hockey, etc.) or an arts program (like a music class, performing arts, language classes, etc.) during the year, you might be able to claim the provincial cost of registering your child in these programs. Remember to keep all your expense receipts in case the Canada Revenue Agency (CRA) asks to see them later.

Click the links below for more information on claiming your provincial fitness tax credit and arts amount:

- Manitoba children's arts and cultural activity tax credit*

- Saskatchewan active families benefit

- Nova Scotia children's sports and arts tax credit

- Prince Edward Island children’s wellness tax credit

- Québec tax credit for children’s activities

- Yukon children’s fitness and arts amount

Note: If you’re a resident of Manitoba, you might be able to claim the fitness amount for yourself (if you’re under the age of 25) and your spouse or common-law partner (if they’re between 18 to 24 years of age).

A prescribed fitness program is one that is:

- Ongoing (at least eight consecutive weeks or, in the case of children’s camps, five consecutive days) and

- Suitable for children, supervised, and must enhance the cardio-respiratory endurance of the child and one or more of the following:

- Muscular strength

- Muscular endurance

- Flexibility

- Balance

Activities that are part of a school curriculum, are unsupervised, or involve riding in or on a motorized vehicle, don’t qualify.

A prescribed arts program must meet the following conditions in order to qualify for the arts amount:

- The program must be ongoing (at least eight consecutive weeks or, in the case of children’s camps, five consecutive days)

- The program must be suitable for children, supervised, and meet one of the following:

- Develops creative skills or expertise in an artistic or cultural activity

- Provides a substantial focus on wilderness and the natural environment

- Develops and uses particular intellectual skills

- Is structured interaction between children where supervisors teach or help children

- Develops of interpersonal skills by structured interaction between children and supervisors or

- Provides enrichment or tutoring in academic subjects

Programs that are part of a school’s curriculum don’t qualify.

No, you can’t claim the same expense under both tax credits. If an expense is eligible for the children's fitness tax credit, it isn’t eligible for the children's arts amount and vice versa.

Before you begin, make sure that you have told us about the dependants, for whom you will be claiming the children’s fitness tax credit and/or arts amount.

Follow these steps in H&R Block’s 2025 tax software:

-

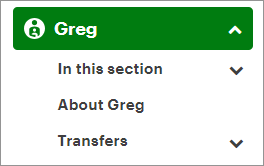

On the left-navigation menu, click the name of your dependant.

- Click About {dependant name}.

- Under the EXPENSES heading, select the checkbox for Physical or artistic activities and click Continue.

- When you arrive at the Children's activities page, enter your information into the tax software.