Are you a volunteer firefighter or a search and rescue volunteer?

The volunteer firefighter’s amount (VFA) or the search and rescue volunteer’s amount (SRVA) is available to volunteer firefighters or search and rescue volunteers who have completed at least 200 hours of eligible services in the year. Eligible services include:

- Responding to and being on call for firefighting or search and rescue emergency calls

- Attending meetings held by the fire department or a search and rescue organization

- Participating in required training related to preventing or suppressing fires or search and rescue work

You can claim an amount of

If, during the year, you provided services to the fire department or the search and rescue organization for which you were paid, you can’t include those hours to meet your 200-hour threshold.

Tax tip: As a volunteer firefighter or search and rescue volunteer, you might be eligible to claim a $1,000 tax exemption on your income. If you choose to claim this income exemption, you can’t claim the VFA or SRVA. Your income exemption amount can be found in box 87 of your T4 slip (or box L-2 of your RL-1 slip, if you’re a resident of Québec). Refer to the CRA website for more information on the income exemption for Emergency Services Volunteers.

If you qualify for the federal VFA or the SRVA amount, you might also be eligible for an additional provincial amount if you’re a resident of British Columbia, Manitoba, Nova Scotia, Newfoundland and Labrador, Nunavut, Prince Edward Island, Québec, or Saskatchewan at the end of the year.

Note: Even if you had income from a source within any of these provinces, you can’t claim this tax credit unless you were a resident as of December 31st.

Click the links below for more information on your provincial tax credit for volunteer firefighters and search and rescue volunteers:

- British Columbia volunteer firefighters and search and rescue volunteers tax credit

- Manitoba volunteer firefighter and search & rescue tax credits

- Newfoundland and Labrador volunteer firefighters’ amount

- Nova Scotia volunteer firefighters and ground search & rescue tax credit

- Nunavut firefighters’ tax credit

- Prince Edward Island volunteer firefighter tax credit

- Saskatchewan volunteer firefighters’ amount, search and rescue volunteers’ amount, and volunteer emergency medical first responders’ amount

- Québec volunteer firefighters and search and rescue volunteers

Note: As a resident of Saskatchewan, you might be able claim the Volunteer emergency medical first responders’ amount (VEMFR) even if you aren’t eligible to claim the VFA or SRVA, as long as you provided at least 200 hours of eligible services to the provincial healthy authority. Eligible services include:

- being on call and responding to medical first responder and related emergency calls

- attending provincial healthy authority meetings

- participating in required training for emergency first responder services

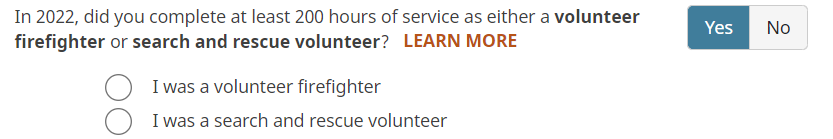

You can claim the VFA or the SRVA on the Special situations page. This page can be found on the left navigation menu under the Required tab by answering the following question:

In 2025, did you complete at least 200 hours of service as either a volunteer firefighter or search and rescue volunteer?

If you’re eligible for the corresponding provincial amount, H&R Block’s tax software will automatically claim it for you if you qualify for the federal amount.

Note: To claim the Saskatchewan VEMFR amount, select I was a volunteer emergency medical first responder.