T4A(OAS): Statement of Old Age Security

If you received a pension from the Old Age Security (OAS) program during the year, you’ll receive the T4A(OAS) slip. This slip shows you how much you received from Employment and Social Development Canada and the income tax deducted.

If you’re between the ages of 60 and 64, the T4A(OAS) will show a spousal amount, if your spouse is receiving the old age security pension and they’re eligible for the guaranteed income supplement (GIS). If you’re a widow between the ages of 60 and 64 and have low income, your survivor allowance will also be shown on this slip. Both amounts are based on your income.

Since the old age security pension is taxable income, you’ll need to enter the amounts from your T4A(OAS) slip into your federal return to determine your net income. If you’re a Québec resident, H&R Block’s tax software will automatically transfer the information you enter on the T4A(OAS) page to your Québec return.

Follow these steps in H&R Block's 2025 tax software:

-

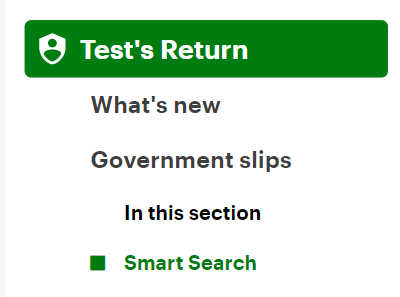

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type T4A(OAS) in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your T4A(OAS), enter your information into the tax software.