I received interest payments from the CRA or Revenu Québec

If the Canada Revenue Agency (CRA) and/or Revenu Québec paid you interest on your 2024 tax refund, you’ll need to report it on your 2025 tax return. You can find this amount on your most recent notice of assessment (NOA) or reassessment.

You might also have received interest payments from the government if your return was reassessed and it was determined that you should have received more than you did. For example, if you applied for and received a disability tax credit certificate and the government told you that you could apply for the disability amount on your previous year’s return, you would be entitled to receive interest payments on the adjusted amount.

The CRA uses a prescribed interest rate to calculate your interest rate, which is compounded daily and starts on the latest of the following dates:

- May 31, 2026

- The 31st day after you file your return or

- The day after you overpaid your taxes

If you’re a resident of Québec, the interest rate that will apply to your refund is the same rate that’s in effect on the first day of the third month of the previous quarter with respect to the most recent issue of Québec Savings Bonds. For more information, refer to the Revenu Québec website.

Follow these steps in H&R Block’s 2025 tax software:

-

On the left navigation menu, under the Credits & deductions tab, click Required.

- In the Instalments/interest received/direct deposit page, answer Yes to one or both of the following questions, as applicable:

- Did you receive any interest payments from the CRA in 2025?

- Did you receive any interest payments form Revenu Québec in 2025?

- Enter your information into the tax software.

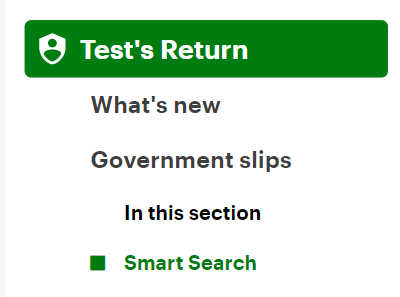

You can also enter the interest payments you received in the Government slips section:

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type either Interest payments received from CRA or Interest received from Revenu Québec in the search field and either click the highlighted selection or press Enter to continue.

- Enter your information into the tax software.