Questions from the CRA and RQ page - FAQs

The Community Volunteer Income Tax Program (CVITP) project is supported by community organizations and the CRA. The CVITP enlists the help of community volunteers to prepare tax returns for eligible individuals for free.

Your answer to this question helps the CRA measure the number of Canadians that are using this valuable service.

Answer Yes to this question if this is the first tax return that you’re filing or the first tax return you’re filing on your own, separately from your parent’s return.

Keep in mind, if you’re filing your return for the first time and want to NETFILE it, there is a possibility your return might be rejected by the CRA, if they don’t have your complete date of birth on file. Click here for more information.

Answer Yes to this question if this is the first tax return that you’re filing or the first tax return you’re filing on your own, separately from your parent’s return.

Note: If you're unable to NETFILE your first Québec return (Revenu Québec might not have information on file for you), you can print a copy of your tax return and mail it to Revenu Québec.

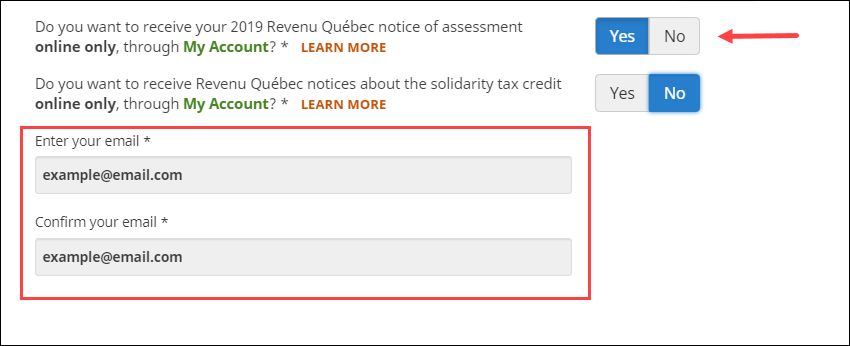

If you file your return online, you can choose to receive your Notice of Assessment (NOA) online instead of having it mailed to you. If you answer Yes to this question, you’ll no longer receive your NOA by mail.

If you choose to receive your NOA online, you’ll be prompted by the tax software to enter your email address here:

Note: Make sure you provide your personal email address (one which you use regularly) to protect your privacy. It is your responsibility to make sure that the Revenu Québec has your correct email address.

Remember:You’ll need to log into your Revenu Québec My Account to see your online NOA. Logging in to My Account is as easy as signing into your online banking! With Revenu Québec's new authentication service, you can log in to My Account in just a few clicks using your online banking identifier and password. It’s easy. It’s My Account!

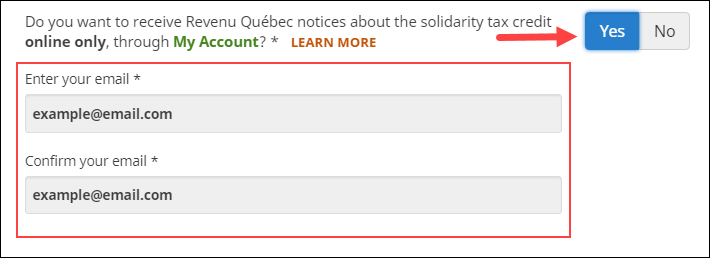

If you answer Yes to this question, Revenu Québec will provide you information about the Solidarity tax credit only through the My Account service; you won’t receive a paper copy of your Solidarity tax credit notices.

If you choose to receive your Solidarty tax credit information online, you’ll be prompted by the tax software to enter your email address here:

Note: Make sure you provide your personal email address (one which you use regularly) to protect your privacy. It is your responsibility to make sure that the Revenu Québec has your correct email address.

Remember: You’ll need to log into your Revenu Québec My Account to see notices for your Solidarity tax credit. Logging into My Account is as easy as signing into your online banking! With Revenu Québec's new authentication service, you can log into My Account in just a few clicks using your online banking identifier and password. It’s easy. It’s My Account!

Once you log into your Revenu Québec My Account, you’ll be able to:

- Claim the Solidarity tax credit

- Notify Revenu Québec about changes to your personal/living situation

- View the status of your file or application and

- Give or revoke consent to receive the Solidarity tax credit notices electronically