Preparing individual and spousal tax returns

According to the Canada Revenue Agency (CRA), both you and your spouse or common-law partner must file your own tax returns. You have the option, however, to prepare your returns separately (uncoupled) or together (as a coupled return) in H&R Block’s tax software.

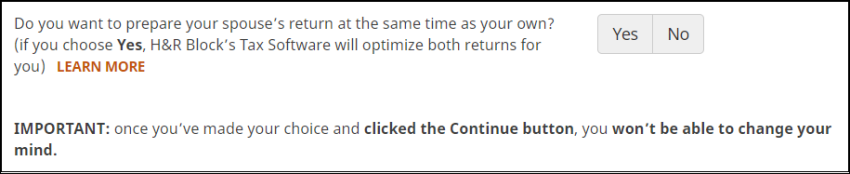

Note: Once you’ve decided to file your return a certain way (either as a coupled or uncoupled return), you can’t change your selection in H&R Block’s tax software. Instead, you would both have to start new returns.

Preparing your return with your spouse typically maximizes your tax savings and minimizes the amount of taxes you might owe. H&R Block’s tax software makes it easy, and calculates the best way to apply the following types of credits between both returns:

- Age amount

- Disability amounts

- Registered Retirement Savings Plan (RRSP) amounts

- Charitable donations

- Medical expenses

- Tuition amounts

- Lifelong learning plan (LLP) amounts

- Dependant amounts

- Pension income amount*

- First-time home buyers’ credit

- Provincial tax credits

* You can only split pension income if you and your partner are filing a coupled return.

No. Your tax bracket (marginal tax rate) does not change based on your marital status. Your tax rate is based entirely on your taxable income. There is no danger of increasing your tax rate or jumping up tax brackets by filing a coupled return.

You can, however, potentially lower the amount of tax you pay, by maximizing the application of tax credits that you and your spouse qualify for, in your returns. For example, some tax credits such as (Donations) can be combined and claimed on one spouse’s return to claim a higher tax credit, while others (such as Pension income) can be split or shared with the spouse. When you prepare your returns together, H&R Block’s tax software will help you optimize your return.

Even if you prepare your return on your own, you’ll still need to enter information from your spouse’s return into yours, and vice versa. This increases the amount of time you’ll spend completing your return, and it could lead to data entry errors.

Yes – if you and your spouse live in different provinces, or if your spouse doesn’t live in Canada, you would need to complete separate returns.

Preparing your returns together is also much easier. When preparing separate returns, you’ll still need to enter information from your spouse’s return into yours and vice versa. This not only increases the amount of time you’ll each spend completing your returns, it might also lead to an increased number of data entry errors.

Only in very rare situations is it advisable to prepare your returns separately. For example, if you and your spouse live in different provinces, or if your spouse doesn’t live in Canada you would need to complete separate returns.