Manitoba fitness tax credit

Manitoba’s fitness tax credit lets you claim expenses you paid for fitness activities for:

- Children under the age of 18

- Young adults 18 through 24 years of age

You can claim up to $500 in eligible fitness activities resulting in a non-refundable benefit of up to $54 per child or young adult. An additional $54 credit for children and young adults with a disability is claimable if at least $100 is spent for fitness activities.

For a child or young adult less than 18 years of age on December 31st, the Manitoba fitness tax credit can be claimed by either the child/young adult or their parent. For young adults who are 18 to 24 years of age, the tax credit can be claimed by the young adult or their spouse or common-law partner.

Eligible fitness expenses are fees paid for the cost of registration, or membership, of the child/young adult in an eligible program of physical activity or membership in an eligible organization. This can include the cost of administration, instruction, rental of required facilities, and uniforms and equipment (that aren’t available for an amount less than their fair market value).

Note: Eligible costs don’t include accommodation, travel, food, or beverages.

An eligible program of physical activity is a program of physical activity that is not part of a school's curriculum and is:

- a weekly program of eight or more consecutive weeks in which all or substantially all of the activities include a significant amount of physical activity

- a program of five or more consecutive days in which more than 50% of the daily activities include a significant amount of physical activity or

- a program of eight or more consecutive weeks offered to children or young adults by an organization where a participant can select from a variety of activities offered as part of the program and

- at least 50% of those activities include a significant amount of physical activity, or

- at least 50% of the time scheduled for those activities offered is for activities that include a significant amount of physical activity.

Physical activity is supervised activity suitable for children or young adults) that contributes to:

- cardio-respiratory endurance and

- muscular strength, muscular endurance, flexibility, or balance

Examples of physical activity are horseback riding, soccer, swimming, skating, and hockey.

For children and young adults with a disability, physical activity should result in movement and in an observable expenditure of energy in a recreational context.

Before you begin, make sure that you told us that you lived in Manitoba on December 31, 2024.

If you’re claiming the Manitoba fitness tax credit for a child or young adult under the age of 18, make sure that you have told us about the dependants for whom you will be claiming the children’s fitness tax credit in the section under Get Started. Then, follow these steps in H&R Block’s 2024 tax software:

-

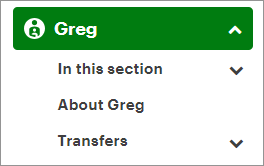

On the left-navigation menu, click the name of your dependant.

- Click About {dependant name}.

- Under the EXPENSES heading, select the checkbox for Physical or artistic activities and click Continue.

- When you arrive at the Children's activities page, enter your information into the Physical activities section.

If you’re claiming the tax credit for yourself, follow these steps in H&R Block’s 2024 tax software:

-

On the left navigation menu, under the Credits & deductions tab, click Other.

- Under the SPECIFIC CREDITS FOR YOUR PROVINCE heading, select the checkbox labelled Manitoba fitness amount.

- When you arrive at the Manitoba fitness amount page, enter your information into the tax software.

Note: To claim the tax credit for your spouse, follow steps 1 to 3 in your spouse's return.