Manitoba fertility treatment tax credit

If you or your spouse or common-law partner received fertility treatment in 2025 from a licensed medical practitioner or infertility treatment clinic in Manitoba, you might be able to claim the Manitoba Fertility Treatment Tax Credit, equal to 40% of the costs of treatment. You can claim up to $20,000 for a maximum of $8,000 per year. There’s no limit on the number of treatments you can claim, as long as the amount claimed isn’t more than the maximum yearly amount.

Note: Either you or your spouse can claim this tax credit but it can’t be split between you both.

You can claim the Manitoba Fertility Treatment Tax Credit if:

- You’re a resident of Manitoba on December 31

- You or your spouse paid for fertility treatments in 2025 and

- The fertility treatment is given by a Manitoba licensed medical practitioner or fertility treatment clinic located in the province

Note: You can’t claim a credit for fertility treatments outside of Manitoba but you can claim any costs from follow-up treatments by a Manitoba physician.

Some examples of treatments that you can claim include:

- Ovulation Induction

- Therapeutic Donor Insemination (TDI)

- Hyperstimulation/Intrauterine Insemination (HS/IUI)

- In Vitro Fertilization (IVF)

- Frozen Embryo Transfer

Keep in mind, this isn't a complete list of eligible treatments. Click here to see which expenses and treatments are eligible.

Note: You can only claim eligible expenses that weren’t reimbursed to you already (for example, by a private health care coverage).

Follow these steps in H&R Block's 2025 tax software:

Before you begin, make sure you tell us that you lived in Manitoba on December 31, 2025.

-

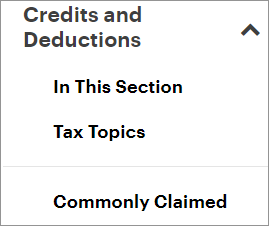

On the left navigation menu, click the Credits & deductions tab and then, the Commonly Claimed heading.

- Under the Credits heading, select the checkbox labelled Medical expenses, then click Continue.

- When you arrive at the page for Medical expenses, enter your information into the field labelled Amount paid to a fertility clinic or licensed physician in Manitoba for infertility treatment services.