Donation tax credit for farmers

As a farmer in Ontario, British Columbia, or Nova Scotia, if you donated agricultural products to a provincial community food program, you might be able to claim the non-refundable donation tax credit for farmers. This credit is worth 25% of the value of your donated products and can be claimed in addition to the charitable donation tax credit.

To be eligible for this tax credit, you or your spouse must have donated the following agricultural products to a registered charity (such as a food bank, or, in the case of British Columbia and Ontario, to an organization that provides meals or snacks to students in a qualifying school):

- Fruits, vegetables, mushrooms

- Meat, fish, eggs, or dairy products

- Grains, pulses, herbs

- Honey, maple syrup

- Nuts, or anything else that is grown, raised, or harvested on a farm

Processed products such as pies, sausages, beef jerky, pickles, and preserves are not eligible for this tax credit.

Click on the links below for more information on each province’s tax credit for farmers:

- British Columbia farmers’ food donation tax credit

- Ontario community food program donation tax credit for farmers

- Nova Scotia food bank donation tax credit for farmers

Follow these steps in H&R Block's 2025 tax software:

Before you begin, make sure you tell us that you lived in British Columbia, Ontario, or Nova Scotia on December 31, 2025.

-

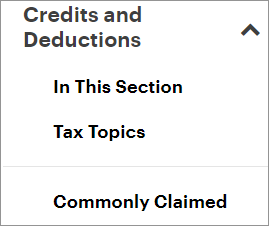

On the left navigation menu, click the Credits & deductions tab and then, the Commonly Claimed heading.

- Under the CREDITS heading, select the checkbox labelled Donations and gifts, then click Continue.

- On the Donations and gifts page, under the Additional information about your donations heading, answer Yes to the question: If you're a farmer, did you donate agricultural products (vegetables, eggs, meat, etc.) to a registered charity that provides food to people in need?

- Enter your information into the tax software.