Does the CRA have a Disability Tax Credit Certificate (form T2201) on file for your dependant?

If your dependant has applied for the disability tax credit (DTC) by submitting a completed T2201: Disability Tax Credit Certificate form to the Canada Revenue Agency (CRA) and it has been approved, then select Yes to this question in H&R Block’s 2025 tax software.

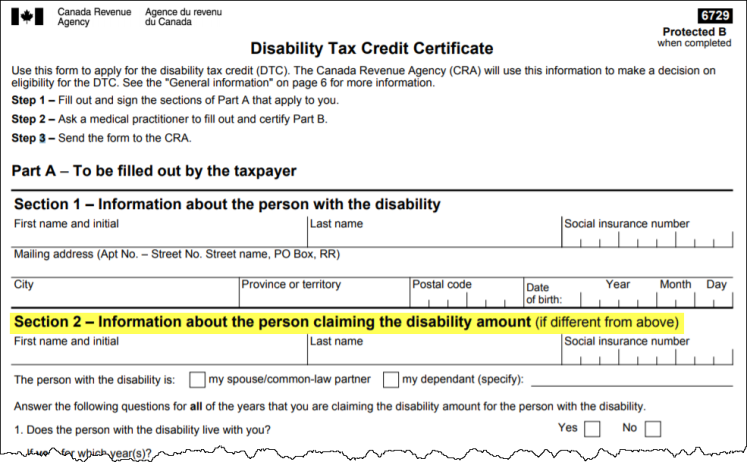

Form T2201 is for individuals who have a severe and prolonged impairment in physical or mental functions and allows them to apply for the disability tax credit. The T2201 form must first be approved by the CRA before the disability tax credit can be claimed.

If your dependant is eligible for the DTC but isn’t using all of the credit amount, he or she can transfer any unused amounts to you as long as you’re named as the person claiming the disability amount on form T2201.