Did your marital status change in 2025?

There are two benefits to keeping your marital status up to date with the Canada Revenue Agency (CRA) or Revenu Québec:

- It allows you to maximize any claims you’re entitled to receive

- It helps to prevent any incorrect claims from being made that might result in you having to pay money back to the government.

A change in your marital status could impact any of the following credits or benefits:

- GST/HST credit

- Canada child benefit (CCB)

- Canada Workers Benefit (CWB)

- Child assistance payments (Revenu Québec)

- Solidarity tax credit (Revenu Québec)

Your marital status determines some of the types of credits you’re eligible for, in your tax return. If your marital status changes, the CRA will recalculate your benefits based on, among other things, your revised net family income.

Tip: If you typically receive these benefits from the government by direct deposit, it might also be a good idea to review the banking information the CRA has on file to avoid payments going into the wrong bank account.

Once you’ve indicated your marital status on the Marital Status on December 31, 2023 page of H&R Block’s tax software, you cannot change your selection. For example, if you indicated that you were single on December 31, 2025 but later realized that the CRA considers you to be in a common-law relationship for tax purposes, you will have to start a new return.

Note: If you indicated that your marital status was:

- Single, separated, divorced, or widowed - you won’t be able to change it once you’ve completed the Get Started section of your return.

- Married or common-law - you won’t be able to change it once you complete the Preparing Your Return page in the Get Started section.

Both the CRA and Revenu Québec require that you inform them of a change in your marital status by the end of the month following the month it changes, except in the case of a separation. For example, if your marital status changes in August 2025, you’ll have to let the CRA/Revenu Québec know no later than September 30, 2025. If you’re separated, you have to wait until the separation lasts for at least 90 days before letting the CRA/Revenu Québec know.

You can tell the CRA by:

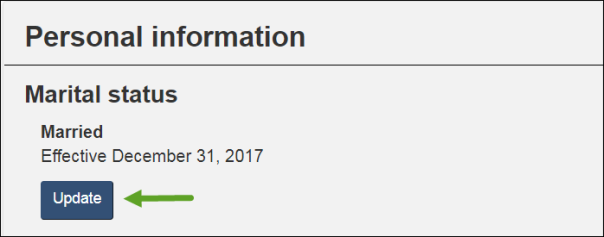

- Logging into the CRA’s My Account service. Then, under Personal profile, click the Update button located in the Marital status section

- Calling 1-800-387-1193 to speak to a CRA representative or

- Completing and mailing-in form RC65: Marital Status Change to the tax centre that assesses your return

Depending on the benefits you receive, there are different ways to contact Revenu Québec. For example, if you receive child assistance payments, you’ll need to contact Retraite Québec by calling 1-800-667-9625. You can also use their Change in Conjugal Status form online.