Unused RRSP/PRPP contributions available for 2025

Unused registered retirement savings plan (RRSP) or pooled registered pension plan (PRRPP) contributions are contributions that have been carried forward from a previous year. If you made RRSP/PRPP contributions in a previous year and reported them on that year’s return but didn’t deduct all of these from your income to lower your tax payable, you will have unused RRSP/PRPP contributions. You can claim your unused RRSP/PRPP contributions in a future year to lower your taxes for that year.

Note: If you made RRSP/PRPP contributions in a previous year but didn’t report them on that year’s return, you’ll need to adjust that year’s return to deduct these contributions from your income.

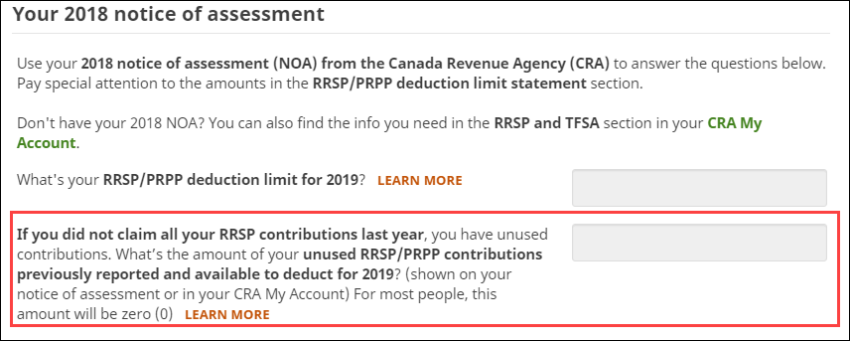

While for most people this amount is zero, you can find your unused RRSP/PRPP contribution amount for 2025 on your:

- 2024 notice of assessment (NOA) or notice of reassessment

- My Account or

- Form T1028 (if applicable)

Note: If you’re downloading your information into your return from the Canada Revenue Agency (CRA)’s website using the AFR service, your RRSP contributions, deduction limit, and any unused amounts will also automatically download into your return.

Example: Katie contributed a total of $2,500 to her RRSP in 2024 but only used $1,500 of it on her 2024 return to reduce her taxes to zero. This means, Katie has $1,000 of unused RRSP contributions that she can claim in 2025 ($2,500 - $1,500 = $1,000). Her 2024 notice of assessment (NOA) also confirms that she has $1,000 in unused RRSP contributions that are available for 2025. In 2025, Katie can claim her unused RRSP contributions on the RRSP contributions and HBP or LLP repayments (Schedule 7) page in H&R Block’s tax software to lower her taxes.

If you don’t need to deduct all of your RRSP contributions for the year and don’t want to carry forward the unused contributions, you can withdraw the excess amount. However, if you decide to do this, you will have to include this amount as income on your return. Click here for more information on what to do with unused RRSP/PRPP contributions.

Follow these steps in H&R Block’s 2025 tax software:

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Type Unused RRSP contributions in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your RRSP contributions and HBP or LLP repayments, enter your unused RRSP/PRPP contributions into the tax software.