Report a loss you had from a business investment (T4037 or TP-232.1-V)

If you’re reporting a business investment loss this year, you might be able to claim it and use it to reduce your taxable income. Generally, you can deduct 50% of the amount of the loss from your income. This amount is called the Allowable Business Investment Loss (ABIL).

You can claim a deduction for your loss if it was the result of:

- selling shares in a small business corporation (whether the sale actually took place or if the shares were just considered to be sold)

- a debt a small business corporation owes you

Under certain circumstances, you might also have a business loss if you are deemed to have disposed of, for zero proceeds, a debt or a share of a small business corporation. Refer to the Canada Revenue Agency (CRA) website for more information.

Note: Be sure to keep details on the disposition on file in case the CRA asks to see them later. Include information such as what was disposed of and why, original purchase date, proceeds of disposition, adjusted cost base (ACB), and outlays and expenses.

Chart 6 of form T4037: Capital Gains is used to calculate your ABIL for federal tax purposes. If you’re a resident of Québec, you’ll also use form TP-232.1-V to calculate the amount for your provincial return.

If your ABIL is greater than your income, you can apply the excess amount to another year. Unused amounts can reduce your income for the past 3 years or be carried forward for up to 10 years.

Depending on the asset that you sold, there are several different expenses that you might’ve had to pay in order to sell them. These can include brokerage and legal fees and, in some cases, accountant or notary fees. For more information, refer to the Revenu Québec website.

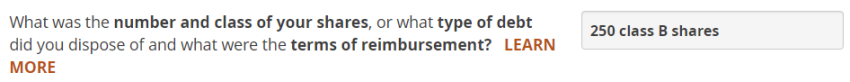

As you complete the TP-232.1-V page in H&R Block’s tax software, you’ll need to indicate the number and class of the shares (or the type of debt) that you’ve disposed. Generally speaking, you’ll receive a record of transaction or a statement from the broker that handled the sale.

For example, your statement might contain the following information:

Number of shares sold: 250

Class: B

Your entry then, on the TP-232.1-V page, might look something like this:

Follow these steps in H&R Block's 2024 tax software:

-

On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

-

Select the Investment income & expenses checkbox.

-

At the bottom of the page, click Add selected topics to my return.

- Under the INVESTMENT INCOME heading, select the checkbox labelled Loss from a business investment.

- If you’re a resident of Québec, also select the checkbox labelled Business investment loss (TP-232.1-V), then click Continue.

- When you arrive at the page(s) for your Business investment loss, enter your information into the tax software.