T2038 (IND): Investment Tax Credit for Individuals

If you invested in or paid for eligible expenses in certain industries, you might be able to claim an investment tax credit (ITC) to lower your federal tax payable. You might be able to claim an ITC if:

- You bought qualified property (such as a new building, machinery, or equipment) and it was used in certain Canadian regions for qualifying farming, fishing, logging, manufacturing, or processing activities

- You’ve done work that qualifies for SR&ED tax incentives

- You employ an eligible apprentice

- You have unclaimed credits that were earned in the last 10 years

- You invested in a mining operation which allocates certain exploration expenses to you

This list isn’t complete. For a full list, visit the Canada Revenue Agency's (CRA) website.

You can also use the T2038 (IND) to carry your unused ITC back up to 3 years or forward up to 20 years, claim a refund of the ITC (see section below), or if you have an ITC recapture on your SR&ED or childcare expenses from previous years.

Important: The ITC for childcare spaces has been cancelled. However, you can still claim any unused amounts which you paid before 2020, to a maximum ITC amount of $10,000 per childcare space created.

Be sure to file your T2038 (IND) form within 12 months of the income tax filing deadline of the year you purchased the property or paid the expense. If you don’t, you’ll need to complete form T1-ADJ: T1 Adjustment Request.

If you have unused ITC amounts, you might be able to get a refund of up to 40% of your unused credit amounts. The amount you can designate as an ITC refund can’t be more than the total credit available for a refund. You can find your total credit available for a refund on the PDF copy of your T2038(IND) form. Refer to the CRA website for more information.

Follow these steps to locate this amount in H&R Block's tax software:

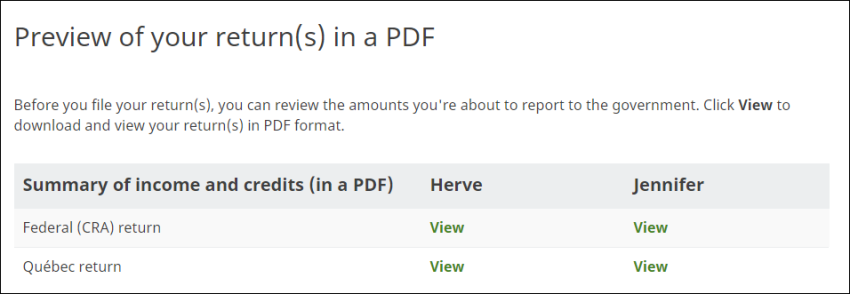

- On the Wrap-Up tab, click SUMMARY.

- Under the Preview of your return(s) in a PDF heading, click View next to the PDF summary that you’d like to take a look at.

- A PDF tax summary will download to your computer.

- Open the file and navigate to the T2038(IND) form. You can find your total credit amount available for refund on line M of the form.

Follow these steps in H&R Block’s 2025 tax software:

Important: If you received a T3 slip with investment tax credit amounts (boxes 40, 41, and 43) and already entered these on the T3 page in H&R Block’s tax software, don’t enter these on the T2038(IND) page again.

-

On the left navigation menu, under the Credits & deductions tab, click Tax Topics.

-

Select the Investment income & expenses checkbox.

-

At the bottom of the page, click Add selected topics to my return.

- Under the INVESTMENT INCOME heading, select the checkbox labelled Investment tax credit for individuals (T2038), then click Continue.

- When you arrive at the page for the Investment tax credit for individuals, enter your information into the tax software.