What is the CRA My Account and how do I register for it?

The Canada Revenue Agency (CRA)’s My Account is a secure portal that lets you view and manage your tax-related and benefits information online. If you have a CRA My Account, you’ll be able to use the Auto-fill my Return (AFR) service in H&R Block’s tax software to automatically complete parts of your tax return with information the CRA has on file for you.

Note: If you and your spouse are preparing your returns together and your spouse has a CRA My Account, your spouse will need to sign into their own CRA My Account. If they’re not available to sign in, they won’t be able to use the AFR service.

With the CRA My Account, you can also:

- View the following on the CRA website:

- detailed status of your tax return

- your notice of assessment (NOA) or reassessment (NOR)

- your unused or carryforward amounts (such as unused tuition amounts, RRSP contributions, etc.) from previous years

- your Home Buyers’ Plan (HBP) and LifeLong Learning Plan (LLP) details

- your benefits’ status and payments

- Download your information slips

- Request an Express NOA

- Start and/or manage your direct deposit details

- Change your personal information

- Receive online mail

Note: This is not a complete list. Refer to the CRA website for a full list of services you can access with the My Account.

Important: To register for My Account, you must have filed a tax return for the current or a previous year.

You have the option to choose from two ways to register for (and later access) your My Account – with a Sign-in Partner (such as your bank) or by creating a CRA user ID and password. Before you begin the registration process, be sure to have your current and/or your previous tax return on hand; for security purposes, the CRA will ask you to enter an amount from a specific line of your return.

-

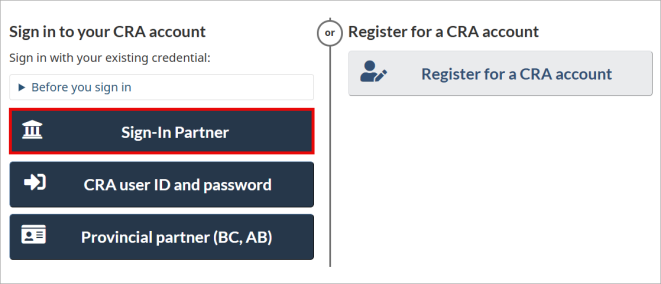

On the

CRA’s My Account for Individuals

page, click the Sign-in Partner button.

-

Select your Sign-In Partner (such as the financial

institution you bank with).

-

You’ll be taken to your Sign-in Partner’s website. Login with your

username and password that you normally use for this website.

-

Enter the requested information (such as your social insurance number,

date of birth, current postal code, and an amount from your current

or previous tax return).

-

Once you complete the registration process, you’ll have instant access

to some of your tax information.

Within 10 business days, you’ll receive a letter from the CRA with your CRA security code. Login to your My Account using your Sign-in Partner. When prompted, enter the CRA security code you received. Keep in mind, your CRA security code has an expiry date – be sure to follow instructions in the CRA letter before the code expires.

Once you enter the CRA security code, you’ll be able to access all of the services offered by My Account.

-

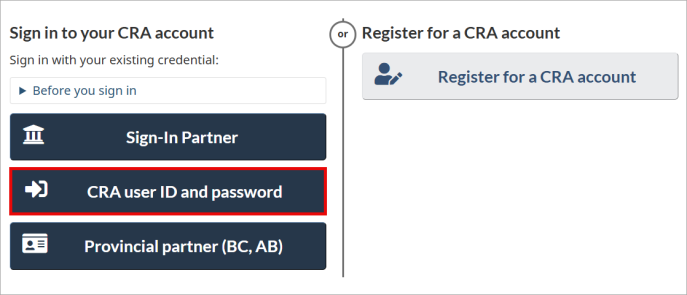

On the

CRA’s My Account for Individuals

page, click the CRA register button.

-

Enter your Social insurance number and click Next.

-

Enter the requested information (such as your date of birth, current

postal code, and an amount from your current or previous tax return).

-

Create a CRA user ID and password.

-

Create your security questions and answers.

-

Once you complete the registration process, you’ll have instant access

to some of your tax information.

Within 10 business days, you’ll receive a letter from the CRA with your CRA security code. Login to your My Account using your CRA user ID and password. When prompted, enter the CRA security code you received. Keep in mind, your CRA security code has an expiry date – be sure to follow instructions in the CRA letter before the code expires.

Once you enter the CRA security code, you’ll be able to access all of the services offered by My Account.

Multi-factor authentication (MFA) is an extra security measure that was added to the CRA’s online services. In addition to your user ID and password, you’ll need to verify your identity by:

-

Telephone (entering a one-time passcode sent to you by text or given to you over the phone)

-

Passcode grid

Beginning on October 18, 2021, you need to set up MFA to access your CRA My Account. To set up MFA, follow these steps:

-

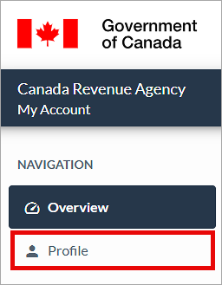

Log into your CRA My Account using your user ID and password or by selecting your sign-in partner.

-

Click Profile.

-

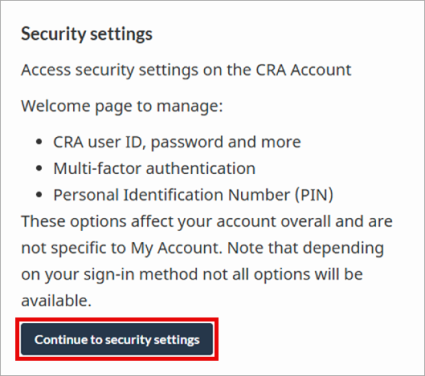

Scroll to the bottom rightof the page to find Security settings.

-

Click Continue to security settingsto continue.

-

You’ll see a pop-up explaining MFA enrollment. Select the checkbox confirming that you’ve read the above information and click Next. You’ll only see this screen if it’s your first time setting up MFA.

-

Choose the type of MFA you want to set up, telephone or passcode grid.

-

If you chose to set up MFA by telephone, you’ll need to enter:

-

The type of phone you’re using (for example, an iPhone 10),

-

Your phone number, and

-

The one-time code sent to you by the CRA to verify your phone number.

If you chose to set up MFA by passcode grid, you’ll need to generate a grid and either save a digital copy to your computer or print off a physical copy for your records.

-

For more information on MFA, visit the CRA website.

If you’ve forgotten your Sign-in Partner username and/or password, contact the organization that’s your sign-in partner to recover or reset these.

If you have forgotten your CRA user ID, you have to provide the following information:

- social insurance number

- date of birth

- the amount you entered on line 150 of your income tax and benefit return, from one of the previous two tax years

After you've provided that information, you'll have to answer your security questions correctly, before you are provided your user ID.

If you have forgotten your CRA password, you’ll need to respond correctly to the security questions you selected when you registered to create a new password. On the CRA’s My Account for Individuals page, click the CRA login button. Click the Forgot your password? link and follow the instructions.

If you’re not sure that you have a CRA My Account, you can try the following things:

Option 1: Sign-in Partner

- On the CRA My Account page, click Sign-In Partner Login/Register.

- You’ll be asked to enter your SIN, postal code, date of birth, and information from your most recent tax return.

If you are unable to access your CRA My Account through your Sign-in Partner, try Step 2 below; otherwise you’ll need to register for My Account again.

Option 2: CRA login credentials

If you are registered for CRA My Account, you’ll be able to recover your user ID by following these steps:

- On the CRA My Account page, click CRA login.

- Click the Forgot your user ID? link.

- You’ll be asked to enter your SIN, date of birth, and the amount on line 150 of your tax return from one of the previous two tax years.

- After you recovered your user ID, you will have to answer four of your five CRA security questions that you originally set up to access your CRA My Account the next time you login.

- If you don’t remember your password, go back to the CRA My Account page and click the Forgot your password? link.

- Enter your user ID and follow the prompts to reset your password.

If you are unable to recover your CRA user ID, you’ll need to register for CRA My Account again.

Important: You can’t start, stop, or update your direct deposit when you NETFILE your return with the CRA. You must update your direct deposit details with them before you file your return; otherwise, the CRA will use the information they already have for you.

Once you log in to the My Account service with either your Sign-in Partner or CRA user id and password, you’ll arrive at the Home page for My Account. Then, follow these steps:

-

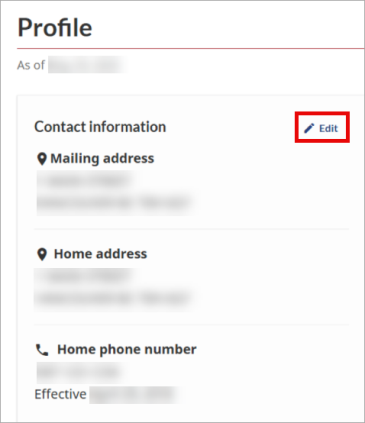

In the left-hand navigation panel, click Edit the

Contact informationoption.

-

Click the button to update your mailing address, home address, and/or

your phone number(s).

- Follow the prompts to change your information.

Important: You can’t start, stop, or update your direct deposit when you NETFILE your return with the CRA. You must update your direct deposit details with them before you file your return; otherwise, the CRA will use the information they already have for you.

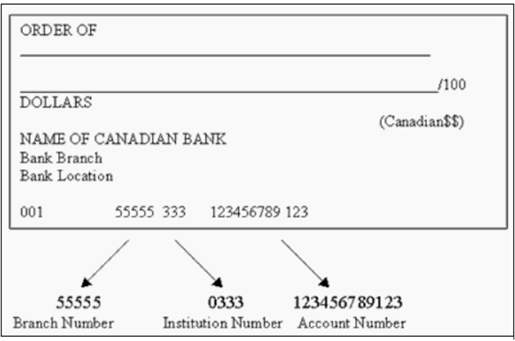

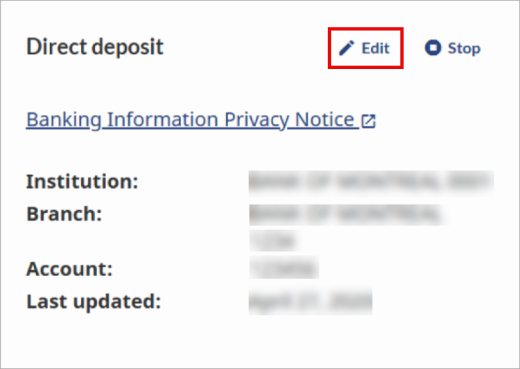

Once you log in to the My Account service with either your Sign-in Partner or CRA user id and password, you’ll arrive at the Home page for My Account. Then, follow these steps:

-

In the right-hand navigation panel, select the

Editoption.

-

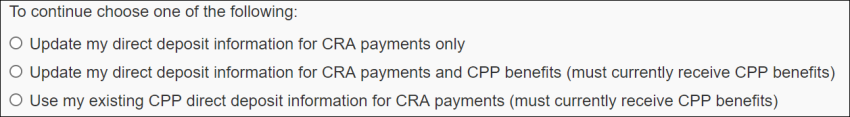

On the Direct deposit page, choose one of the three

options that applies to you and click Next.

-

On the Manage direct deposit page, enter your bank information

(branch number, institution number, and account number) for each type

of payment listed and click Next. You can find this

information on a cheque for your account.