What is net income?

Your net income is your total income for the year (from all sources, such as employment, RESPs, retirement income, benefits, etc.) minus your allowable deductions (such as RRSP contributions, childcare expenses, moving expenses, etc.)

The Canada Revenue Agency (CRA) uses your net income to determine the:

- federal and provincial or territorial non-refundable credits you might be eligible for (including the credit amounts) such as the Age amount or Spouse or common-law partner amount

- social benefits you might receive like the GST/HST credit or the Canada child benefit

Revenu Québec also uses your net income to calculate the Solidarity Tax Credit and the Family Allowance credit for Québec residents.

Note: If you and your spouse or common-law partner are filing your returns separately in H&R Block’s tax software, you’ll need to enter your spouse’s net income for the year on the Your spouse’s return page under Required. This tab can be found on the left navigation menu under the Credits & deductions tab.

Follow these steps to locate your 2025 net income amount in H&R Block's tax software:

Note: Before you access this information, make sure you’ve entered all of your slips, receipts, and completed all of the relevant sections of your return (example, any self-employment page(s), claimed allowable deductions, etc.).

- On the left navigation menu, under Wrap-Up, click SUMMARY.

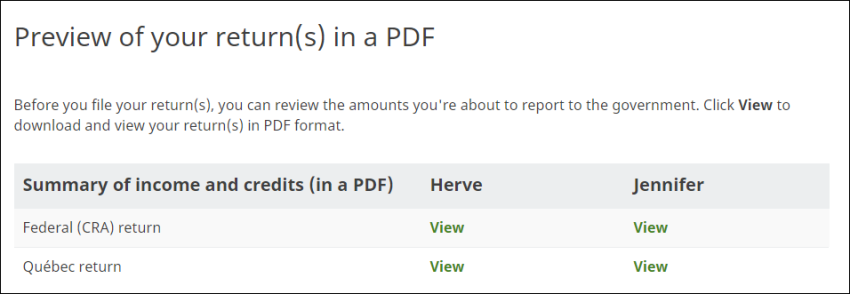

- Under the Preview of your return(s) in a PDF heading, click View next to the PDF summary that you’d like to take a look at:

- A PDF tax summary will download to your computer.

- Open the file.

- Your federal net income is reported on line 23600

- Your Québec net income is reported on line 275

Note: If you need this information to complete the Newcomers page in H&R Block's tax software, you’ll also need to determine how much of the income reported on line 23600 was earned while your spouse was living in and outside of Canada (if applicable).

- Line 23600 – Net income (Canada Revenue Agency website)

- TP-1.D-V: Income tax return (Revenu Québec website)