How can I optimize my return?

H&R Block’s tax software helps you optimize the information you’ve entered into your tax return -- allowing you to lower your taxable income, apply for additional credits, and even split tax credits or transfer them to your spouse (if applicable).

Depending on your eligibility and the information you’ve already entered in your return, you’ll be able to claim the following credits and deductions on this page by answering a few additional questions:

- Your RRSP claims – You’ll be able to see the amount that’s available to be claimed this year and enter the amount you want to claim. Any remaining amount will be carried forward to next year.

- Splitting your pension income - If you earned pension income during the year, you can choose to split this income with your spouse to lower your taxable income.

- Québec tax shield credit – You can choose to have Revenu Québec calculate this credit for you.

- Québec solidarity tax credit - Based on the information you provide in this section, Revenu Québec will calculate your credit amount. You’ll be able to see this amount on your notice of determination for July 2025 to June 2026.

- Québec tax credit for income averaging as a forest producer – You’ll be able to see the maximum allowable amount for this year and enter the amount you want to claim.

- Québec cooperative investment plan (CIP) deduction – You’ll be able to see the amount that’s available to be claimed this year and enter the amount you want to claim. Any remaining amount will be carried forward to next year.

On this page, you’ll be able to make sure that you’ve claimed all your eligible dependant credits and optimize your dependant’s amounts, including the eligible dependant amount and in certain cases, child care expenses.

On this page, you’ll see a breakdown of the credits and expenses you’ve entered in your return and those that have been claimed for you. Certain credits and deductions (such as the basic personal amount, age amount, Canada employment amount, interest paid on your student loan and more) are claimed automatically for you are based on your specific tax situation and can’t be claimed differently.

You can also transfer your federal and provincial tuition amounts on this page (that you didn’t use to reduce your own taxes), to an eligible family member to help them lower their tax payable.

Note: If you and your spouse are preparing your returns together, you’ll be able to transfer your unused federal and provincial tuition amounts to your spouse on the Optimized Credits page.

An eligible family member can be:

- Your spouse or common-law partner

- Your parent or grandparent or

- Your spouse’s or common-law partner’s parent or grandparent

Note: Only the current year’s unused tuition amounts can be transferred. You can’t transfer any unused tuition amounts that you carried forward from a previous year.

Things to keep in mind:

- If your spouse is claiming the spousal (or common-law partner) amount on your behalf, your spouse is the only person you can transfer your unused tuition amounts to.

- You must transfer your unused federal and provincial tuition amounts to the same person.

If you don’t want to transfer your tuition amounts, don’t worry – H&R Block’s tax software will carry forward these amounts so you can claim them in a future year. You’ll see the carry forward amounts on your completed return and on your notice of assessment for the year.

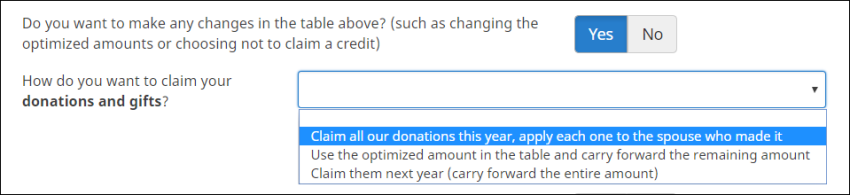

On this page, you’ll be able to see some of your credits that were optimized to lower your tax payable. You can choose to keep the optimized amounts or change them.

For example, if you made donations this year, you can either claim all your donations this year, use the optimized amount given in the table on this page and carry forward any remaining amount, or carry forward the entire donations amount.

If you and your spouse are preparing your returns together, you’ll be able to transfer your unused federal and provincial tuition amounts to your spouse on this page. Only the current year’s unused tuition amounts can be transferred. You can’t transfer any unused tuition amounts that you carried forward from a previous year.

If you don’t want to transfer your tuition amounts, don’t worry – H&R Block’s tax software will carry forward these amounts so you can claim them in a future year. You’ll see the carry forward amounts on your completed return and on your notice of assessment for the year

If you make any changes on this page, click the Optimize again button to re-optimize your return.

If your marital status for the year was “married” or “common-law”, we’ll show you a list of credits (such as the disability amount) that can be transferred between you and your spouse or common-law partner. If you make any changes on this page, click the Optimize again button to re-optimize your return.