What is the NETFILE Access Code (NAC)?

The NETFILE Access Code (NAC) is an 8-character code that is used as an added security measure by Canada Revenue Agency (CRA) to verify your identity when you NETFILE your return.

New this year, you’ll be asked to enter your unique NAC in H&R Block's tax software. Entering your NAC in the tax software isn’t mandatory; you’ll still be able to NETFILE without it.

However, if you don’t enter it, you won’t be able to use any information from your 2025 tax return to confirm your identity with the CRA when you call them. You’ll need to use other information to authenticate your identity.

Note: The NAC doesn’t apply to you if you are filing your tax return for the first time.

Where do I enter my NAC in H&R Block's tax software?

My return was rejected because of an incorrect NAC. What should I do?

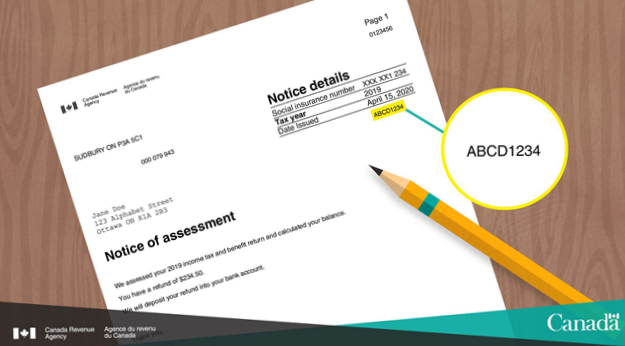

Your unique NAC code is located on the right side of your Notice of Assessment (NOA) for the previous tax year. On the paper version of your NOA, the NAC can be found on the right side under Date issued.

Image courtesy of the Canada Revenue Agency (CRA)

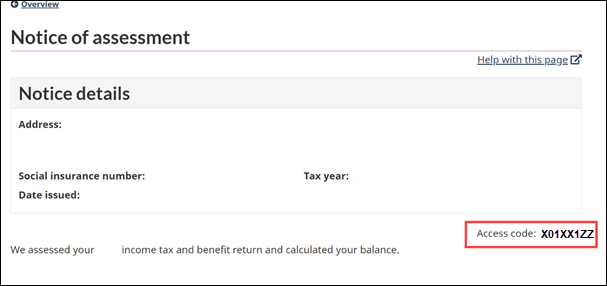

If you’re viewing your NOA in CRA My Account, your NAC is labelled Access code and can be found under the Notice details box.

Important: If you’re filing your Canadian return for the first time, you won’t need to enter a NAC.

To enter your NAC in H&R Block's 2025 tax software, follow these steps:

-

On the left navigation menu, under Get Started, click .

-

On the page, enter your NAC in the field labelled NETFILE Access Code.

Note: If you’re preparing your return with your spouse or common-law partner, you can enter their NAC in the NETFILE Access Code field on the bottom of the same page.

Remember, you’ll still be able to NETFILE your return if you don’t enter your NAC but won’t be able to use information from your 2025 tax return to confirm your identity with the CRA.

You’ll see the following error message if you enter an incorrect NAC and try to NETFILE your return:

The Canada Revenue Agency was unable to accept your return, as your NETFILE Access code did not match our records. Please compare what you have entered with the access code shown on your notice of assessment.

To fix this error, you can do one of the following:

-

Go back to the NAC field and enter your NAC exactly as it appears on your notice of assessment (NOA). Your NAC is case-sensitive. You have 5 attempts to enter a correct NAC and NETFILE before the CRA blocks your account. If that happens, you'll need to contact the CRA for more information.

-

Go back to the NAC field and remove your entry. Since this field is optional, you can NETFILE without it. You just won’t be able to use information from your 2020 tax return to confirm your identity with the CRA when you call them.

-

You can print and mail your return to the government. If you’re unable to NETFILE your return because the CRA has blocked your account, you’ll still be able to file a paper version.