Error code 354

You’ll see the following error in H&R Block’s 2025 tax software if, on the T4: Statement of remuneration paid page, you indicated that you’re EI exempt but you also entered an amount for your EI insurable earnings or EI premiums:

You checked EI for box 28 on the T4 page, indicating you're EI exempt. But you also entered an amount in box 24 (EI insurable earnings) or box 18 (Employee's EI premiums). Make sure you entered the amounts and information shown on the T4 slip correctly. If you entered what's shown on the slip correctly, contact the issuer of the slip. [error code: 354]

How do I fix this?

To correct the error, return to the T4 page and make sure you entered the information from the T4 slip you received, correctly.

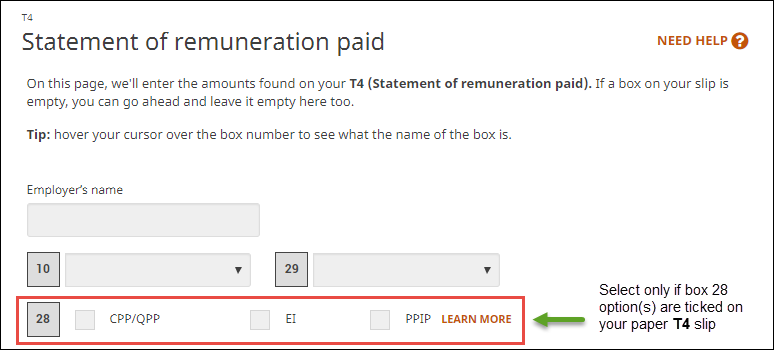

When you enter information from your T4 slip into H&R Block's tax software, select an option for box 28 only if an X appears in the CPP/QPP, EI, or PPIP box of your T4 slip. You should leave box 28 blank if CPP/QPP, EI, and/or PPIP amounts were deducted from your pay during the year.

Note: You can enter your T4 slip on the Smart Search page under the Government slips tab on the left navigation menu.