T4: Statement of Remuneration Paid

If you were employed during the year, you’ll receive a T4: Statement of Remuneration Paid slip from your employer. This slip shows the income you earned in the year as well as any deductions (such as income tax, CPP and EI contributions, union dues, etc.).

If you worked at more than one job, you’ll receive a separate T4 from each of your employers. If you worked in multiple provinces, you’ll get a separate T4 for each province.

Box 14 of

- Salary or wages

- Commissions

- Bonuses

- Vacation pay

- Tips and gratuities

- Taxable benefits or allowances (such as board and lodging, employment commissions, etc.)

- Management fees

- Payments out of an employee benefit plan

Note: This isn’t a complete list. For more information, refer to the Canada Revenue Agency (CRA) website.

Yes. If you’re a resident of Québec, you’ll not only get a federal T4 slip from your employer but also an RL-1: Employment and other income slip that reports your Québec-based income as well as any amounts deducted from that income. You’ll need to enter the information from your T4 and RL-1 slips into H&R Block’s 2025 tax software to correctly calculate your tax payable or refund.

You’ll receive a separate T4 and RL-1 slip from each Québec-based employer you had during the year.

Since federal and Québec income taxes are calculated differently, certain amounts on your T4 and RL-1 slips might not be the same. For example, employer contributions to private health insurance plans are considered taxable income in Québec and are included in the employment income amount on the RL-1 slip. That is not the case federally. Be sure to enter amounts from both your T4 and RL-1 slips into H&R Block’s tax software to correctly calculate your tax payable or refund.

If you have an amount showing in box 52 (pension adjustment) of your T4 slip, it won’t affect your refund amount or tax owing, but it will reduce your RRSP deduction limit for the following year.

Your T4 will contain a pension adjustment amount in box 52 if you belong to a company-sponsored registered pension plan (RPP) or to a deferred profit-sharing plan (DPSP). A pension adjustment helps to even the playing field between employees who belong to an employer-sponsored plan and those who don’t.

Let’s take a look at an example for two taxpayers who both earned $50,000 in 2024.

Jason doesn’t belong to an RPP. Given his income in 2024, he’s entitled to contribute $9,000 to his RRSP in 2025 ($50,000 x 18%).

Natalie belongs to an employer-sponsored plan. During 2024, her employer made regular contributions to the registered pension plan on her behalf for a total amount of $1,250. This means her T4 will show a pension adjustment amount of $1,250 and she’ll be entitled to contribute $7,750 to her RRSP in 2025 [($50,000 x 18%) - $1,250].

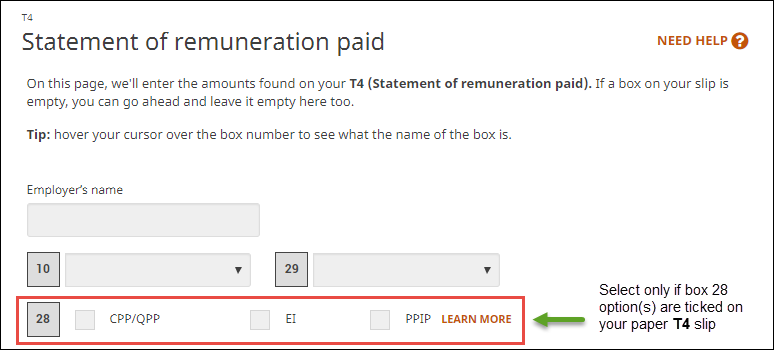

Box 28 on your T4 slip specifies CPP/QPP, EI, and PPIP exemptions. This means that your employer did not withhold (or deduct) CPP/QPP contributions, EI premiums, and/or PPIP premiums from your pay.

When you enter information from your paper T4 slip into H&R Block’s tax software, be sure to select an option for box 28 only if an X appears in the CPP/QPP, EI, or PPIP box of your paper T4 slip.

You should leave box 28 blank if CPP/QPP, EI, and/or PPIP amounts were deducted from your pay during the year.

Note: If you select any of the options in box 28 and your earnings aren’t exempt from that withholding, you’ll have to pay back any additional tax refund amount that you received as a result of making this selection to the Canada Revenue Agency (CRA).

In addition to reporting your employment income in Box 14 or Code 71, your employer will use these boxes to report any income or retroactive payments you were paid between the following dates in 2020:

-

Box 57: March 15 to May 9

-

Box 58: May 10 to July 4

-

Box 59: July 5 to August 29

-

Box 60: August 30 to September 26

Your eligibility for the Canada Emergency Response Benefit (CERB) and Canada Emergency Student Benefit (CESB) may be affected by the income you earned during these periods. However, it’s important to report these amounts on your tax return. Unclaimed income, unintentional or otherwise, is considered tax evasion by both the CRA and Revenu Québec and can result in significant penalties.

No. When you NETFILE your taxes, you don’t need to send any slips (or copies of slips) to the CRA or Revenu Québec. You should, however, hang on to these documents and other tax-related information for at least six years after you file, in case either agency asks to see them.

If you haven’t received a T4 slip from your employer or have misplaced the one you did receive, you can ask your employer to provide another copy to you. You can also log into the CRA’s My Account service (registration required) to download or print a copy of your T4 slip(s).

Follow these steps in H&R Block’s 2025 tax software:

-

On the left navigation menu, click the Government slips tab, then Smart Search.

- Enter T4 in the search field then click the highlighted selection or press Enter to continue.

- When you arrive at the page for your T4, enter your information into the tax software.

Note: If you also received an RL-1 slip from your employer(s), follow the steps above to enter your information into the tax software.